Finances : Are you looking for effective ways to boost your financial health and start saving more money? In today’s challenging economic climate, it’s more important than ever to have a solid plan in place to improve your finances. With the right strategies and actionable tips, you can take control of your money and work towards a more secure financial future.

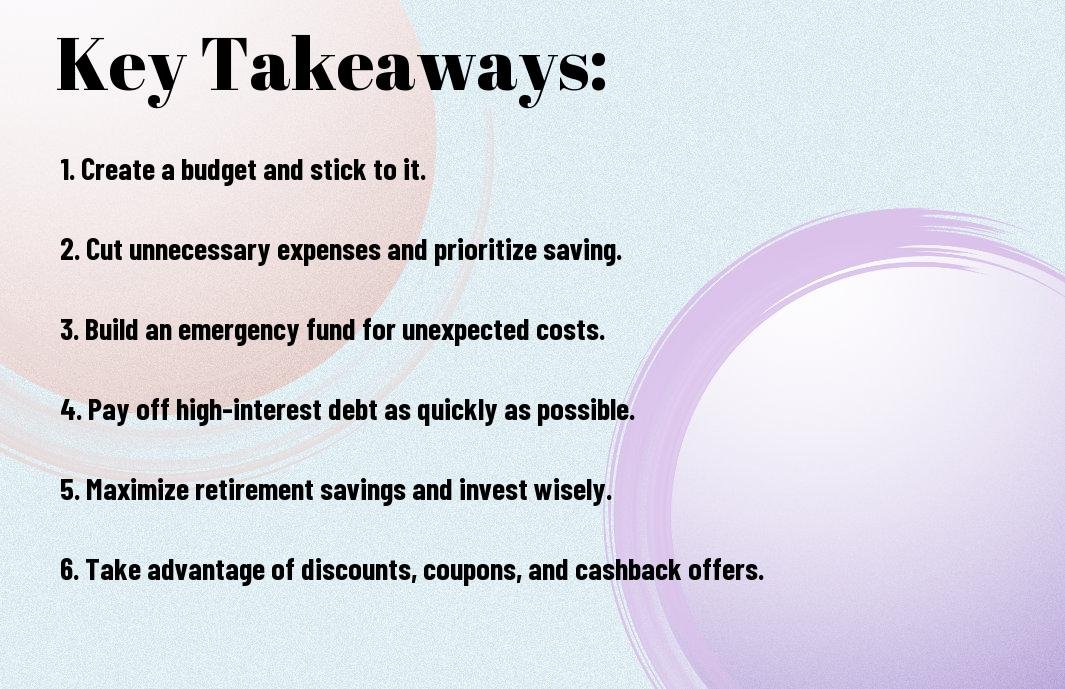

Key Takeaways:

- Create a budget: Setting a budget allows you to track your expenses and see where your money is going. It helps you prioritize spending and identify areas where you can cut back.

- Automate your savings: Take advantage of automatic transfers to a separate savings account to ensure a portion of your income goes towards savings each month without you having to think about it.

- Shop smarter: Look for deals, compare prices, and consider buying generic brands to save money on everyday items. Additionally, avoid impulse purchases and only buy what you truly need.

Setting Clear Financial Goals

If you want to improve your finances and save money, the first step is to set clear financial goals. Setting specific targets for your financial future will give you a clear direction and purpose, helping you stay focused and motivated. Whether you’re aiming to pay off debt, build an emergency fund, or save for a big purchase, having clear financial goals is essential to your success.

Short-term vs. Long-term Goals

Clear distinctions should be made between short-term and long-term financial goals. Short-term goals typically involve achieving financial milestones within the next year, such as paying off a credit card or saving for a vacation. Long-term goals, on the other hand, may include retirement planning, buying a home, or funding a child’s education. It’s important to prioritize both short-term and long-term goals to ensure that you’re making progress in all areas of your financial life.

SMART Goal-Setting for Finances

Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals is a proven strategy for successful financial planning. When it comes to finances, SMART goals can help you clarify exactly what you want to accomplish and create a roadmap for achieving it. Whether it’s increasing your savings rate, reducing your monthly expenses, or earning additional income, using the SMART criteria can significantly increase your chances of reaching your financial goals.

SMART goal-setting helps you avoid vague or ambiguous goals, and instead, focuses on creating a specific action plan with measurable milestones. By breaking down your financial objectives into smaller, achievable tasks, you’ll be able to track your progress and stay motivated along the way.

Creating a Realistic Budget

After realizing the importance of budgeting, the next step is to create a realistic budget that fits your financial situation. Without a budget, it’s difficult to keep track of your spending, save money, or work towards financial goals. A realistic budget takes into account your income, expenses, and financial goals, and serves as a roadmap for your financial journey.

Types of Budgeting Methods

Creating a budget can be done through various methods, such as zero-based budgeting, 50/30/20 budgeting, or percentage-based budgeting. Each method has its own advantages and can cater to different financial situations. Zero-based budgeting ensures that every dollar is allocated to a specific purpose, while 50/30/20 budgeting allocates 50% of income to needs, 30% to wants, and 20% to savings or debt payments. Percentage-based budgeting allocates a certain percentage of income to different expense categories. Any budgeting method chosen should reflect your income, financial goals, and spending habits.

| Zero-based budgeting | Allocates every dollar to a specific purpose |

| 50/30/20 budgeting | Allocates 50% of income to needs, 30% to wants, and 20% to savings or debt payments |

| Percentage-based budgeting | Allocates a certain percentage of income to different expense categories |

Tracking Expenses and Income

Creating a realistic budget entails tracking your expenses and income. This involves recording all your income sources and spending habits to ensure that your budget aligns with your actual financial situation. Regularly tracking your expenses and income allows you to identify areas where you can save money and make necessary adjustments to your budget. Importantly, this process helps in maintaining financial discipline and enables you to work towards achieving your financial goals.

Types of budgeting methods, such as zero-based budgeting and percentage-based budgeting, require diligent tracking of expenses and income to ensure that the budget is being followed accurately. By keeping a close eye on your finances, you can make informed decisions about your spending and saving habits, leading to financial stability and progress towards financial goals.

Adjusting Your Budget as Needed

The process of budgeting doesn’t end with its creation. The key to maintaining a successful budget is the ability to adjust it as needed. Financial circumstances and priorities may change over time, requiring adjustments to your budget. Whether it’s an unexpected expense, a change in income, or a new financial goal, being able to adapt your budget accordingly is crucial for staying on track.

Realistic budgeting involves regular reviews and adjustments to ensure that it accurately reflects your financial situation and goals. Being flexible and proactive in adjusting your budget as needed can help you stay in control of your finances and avoid unnecessary stress. Any changes made to the budget should align with your financial objectives and continue to support your overall financial well-being.

Eliminating Debt

Not taking control of your debt could lead to financial disaster. It’s important to prioritize paying off debt in order to achieve financial stability and security. By eliminating debt, you can free up more money to save and invest for the future.

Strategies to Pay Down Debt Faster

With disciplined budgeting and prioritizing high-interest debt, you can accelerate the process of paying down your debt. Consider consolidating multiple debts into a single lower-interest loan, and always pay more than the minimum amount due each month. Another effective strategy is the debt snowball method, which involves paying off your smallest debt first and then using the freed-up money to pay off larger debts. This method helps build momentum and motivation to continue paying down debt faster.

Understanding Good Debt vs. Bad Debt

Faster is not always better when it comes to paying off debt. It’s important to distinguish between good debt, which can help build wealth over time, and bad debt, which tends to be high-interest and non-investment generating. Good debt includes mortgages and student loans, while bad debt includes high-interest credit card debt and personal loans. Strategies to pay down bad debt and manage good debt can help you make sound financial decisions for your future.

Negotiating with Creditors

Negotiating with creditors can be intimidating, but it’s a powerful tool for managing and eliminating debt. Contact your creditors to explore options such as lower interest rates, extended payment terms, or debt settlement offers. By negotiating with creditors, you can potentially reduce the total amount of debt owed and create a more manageable repayment plan.

Building an Emergency Fund

Keep yourself financially secure by building an emergency fund. This fund will provide you with a safety net in case of unexpected expenses and emergencies, helping you avoid going into debt.

How Much to Save

Save at least three to six months’ worth of living expenses in your emergency fund. This amount can vary depending on your individual circumstances, such as job stability, family size, and health status. It’s important to carefully assess your needs and create a realistic savings goal.

Save any windfalls or bonuses you receive, such as tax refunds or work bonuses, directly to your emergency fund to help reach your savings goal faster.

Best Practices for Growing Your Fund

The key to growing your emergency fund is to consistently contribute to it. Consider setting up automatic transfers from your checking account to your emergency fund to ensure regular contributions. Additionally, consider increasing your contributions whenever you receive a raise or pay off a debt to accelerate your savings.

The emergency fund should be kept separate from your regular checking and savings accounts to prevent the temptation of using it for non-emergencies.

Much like a garden, your emergency fund requires regular attention and care to flourish. By being intentional about your contributions and keeping the fund separate, you can watch it grow and provide the security you need.

Where to Keep Your Emergency Fund

On of the most important aspects of an emergency fund is accessibility. It’s crucial to keep your fund in an account that is easily accessible, such as a high-yield savings account or a money market account. These options offer the potential for modest returns while still allowing you to withdraw funds quickly in case of an emergency.

Plus, keeping your emergency fund separate from your regular accounts helps you avoid the temptation to spend it on non-emergencies while still earning a higher interest than a traditional savings account.

Investing Wisely

Unlike saving money in a bank account or under the mattress, investing allows your money to grow over time. However, it is crucial to approach investing wisely in order to minimize risks and maximize returns.

When it comes to investing, it’s important to diversify your portfolio. Diversification can help spread risk across different types of investments, reducing the impact of any one investment’s performance on your overall portfolio. Additionally, research and educate yourself about different investment options before making any decisions.

One of the most dangerous mistakes that investors make is putting all their eggs in one basket, by investing in only one type of asset or company. This can lead to significant losses if that particular investment doesn’t perform well. On the other hand, the positive side of investing wisely is the potential for significant returns and long-term growth.

Remember, investing is a long-term game, and it’s important to have a clear strategy and consistent approach. By investing wisely and being patient, you can build wealth and secure your financial future.

Also Refer : 10 Essential Personal Finance Tips To Help You Save And Invest

FAQs

Q: What are some smart strategies to improve finances and save money?

A: Some smart strategies include creating a budget, prioritizing expenses, finding ways to increase income, and reducing unnecessary spending.

Q: Why is creating a budget important for improving finances?

A: A budget helps track income and expenses, identify areas for improvement, and set financial goals.

Q: How can I prioritize my expenses to save money?

A: Prioritize essential expenses such as housing, utilities, and debt payments, while minimizing non-essential costs like dining out and entertainment.

Q: What are effective ways to increase income to improve finances?

A: Side gigs, freelancing, or seeking higher-paying job opportunities are effective ways to increase income and improve finances.

Q: How can I reduce unnecessary spending and save money?

A: Track discretionary spending, avoid impulse purchases, and look for cost-saving alternatives for regular expenses.

Q: Is it important to build an emergency fund to improve finances?

A: Yes, having an emergency fund helps cover unexpected expenses and prevents the need to rely on credit cards or loans, which can lead to debt.

Q: What role does investing play in improving finances?

A: Investing can help grow wealth over time, and options such as retirement accounts and stocks can provide a source of passive income and financial security.