FAQ

Q: What is a credit score?

A: A credit score is a numerical representation of an individual’s creditworthiness, based on their credit history. It is used by lenders to assess the likelihood that a borrower will repay their debts.

Q: Why is having a strong credit score important?

A: A strong credit score is important because it helps you qualify for better interest rates on loans and credit cards. It can also affect your ability to rent an apartment, get a job, or even secure insurance at lower rates.

Q: How can I build a strong credit score?

A: You can build a strong credit score by consistently paying your bills on time, keeping your credit card balances low, and only opening new accounts when necessary. It’s also important to regularly check your credit report for errors and to avoid applying for too much credit at once.

Q: What factors affect my credit score?

A: The factors that affect your credit score include your payment history, credit utilization, length of credit history, new credit, and types of credit used. Each of these factors carries a different weight in determining your overall credit score.

Q: Can I improve a bad credit score?

A: Yes, you can improve a bad credit score by following good credit habits. This includes paying your bills on time, reducing your credit card balances, and addressing any errors on your credit report. Over time, these actions can help improve your credit score.

Q: How long does it take to build a strong credit score?

A: Building a strong credit score takes time and consistent effort. While there is no specific timeline, it typically takes several months to see significant improvements in your credit score. However, building an excellent credit score may take years of responsible credit management.

Q: What should I do if I have no credit history?

A: If you have no credit history, you can start by opening a secured credit card or becoming an authorized user on someone else’s credit card. You can also consider a credit-builder loan or applying for a credit card designed for individuals with limited credit history. By using credit responsibly, you can begin to build a positive credit history.

Obtaining financial freedom is a goal that many people strive for, and a crucial step in achieving this is by building a strong credit score. A good credit score can open doors to low interest rates on loans, better credit card terms, and even help when renting an apartment or applying for a job. In this blog post, we will explore key tips for building and maintaining a strong credit score, as well as the pitfalls to avoid that could harm your financial future.

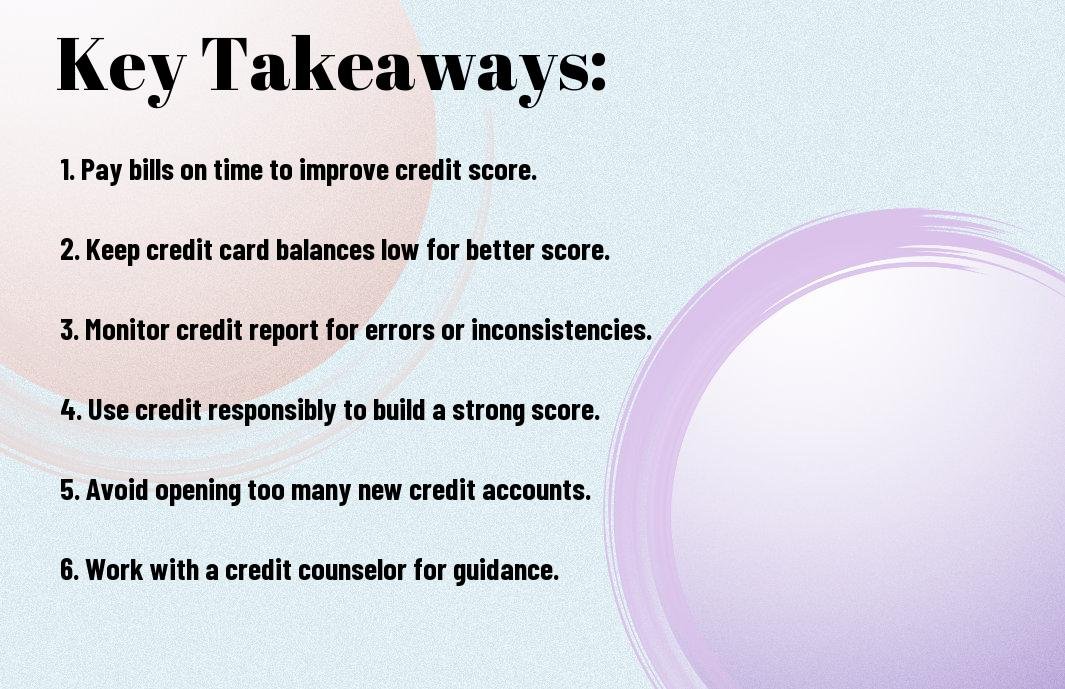

Key Takeaways:

- Importance of a strong credit score: A strong credit score is crucial for obtaining favorable interest rates on loans and credit cards, as well as for renting an apartment or even getting a job.

- Tips for building a strong credit score: Consistently making payments on time, keeping credit card balances low, and monitoring your credit report for errors are important steps in improving your credit score.

- Patience is key: Building a strong credit score takes time and consistent financial habits. It’s important to be patient and stay committed to healthy financial habits to see long-term improvement.

Understanding Credit Scores

Assuming you are on the path to financial freedom, having a strong credit score is essential. Credit scores play a crucial role in determining your access to loans, credit cards, and favorable interest rates. Understanding how credit scores work is key to building and maintaining a healthy financial profile.

What is a credit score?

One of the most important aspects of your financial health is your credit score. This three-digit number is a reflection of your creditworthiness and is used by lenders to assess the risk of lending to you. A higher credit score indicates a lower risk, making you more likely to qualify for loans and credit at favorable terms. Conversely, a lower credit score may limit your access to credit or result in higher interest rates.

How are credit scores calculated?

Credit scores are calculated using a variety of factors, including your payment history, credit utilization, length of credit history, new credit inquiries, and the types of credit accounts you have. credit score calculations take into account both positive and negative information on your credit report, giving lenders a comprehensive view of your creditworthiness.

Any missed payments, high credit card balances, or recent credit inquiries can negatively impact your credit score. Conversely, a long history of on-time payments, low credit utilization, and a diverse mix of credit accounts can help boost your score.

The impact of a low vs. high credit score

Impact of a credit score is significant when it comes to your financial well-being. A low credit score can make it challenging to qualify for loans, credit cards, or favorable interest rates. It may also result in higher insurance premiums or security deposits for utilities. In contrast, a high credit score opens up opportunities for better loan terms, lower interest rates, and access to premium credit cards with exclusive benefits.

The Foundations of a Strong Credit Score

Unlike other financial metrics, a credit score reflects an individual’s creditworthiness. It serves as a key factor in determining the terms of loans, credit cards, and mortgages. A strong credit score is built on several foundational pillars, each of which plays a crucial role in determining the overall health of an individual’s credit profile.

Establishing credit history

Score One of the key elements in building a strong credit score is establishing a solid credit history. This involves making on-time payments for credit cards, loans, and other forms of credit. Lenders rely on this historical data to assess an individual’s reliability in meeting financial obligations. An insufficient credit history can lead to a lower credit score, making it challenging to qualify for loans and credit cards.

Strong credit scores are founded on a history of responsible credit use, which demonstrates an individual’s ability to manage debt effectively.

The role of credit cards

The use of credit cards can significantly impact a person’s credit score. Responsible use, such as making timely payments, staying within credit limits, and avoiding excessive debt, can contribute to a strong credit profile. However, misuse, such as late payments or carrying high balances, can have negative consequences on an individual’s credit score.

The Foundations of a strong credit score are strengthened by the proper utilization of credit cards, emphasizing the importance of maintaining a healthy credit utilization ratio and demonstrating responsible credit management.

Credit management that includes a diverse mix of credit types, such as installment loans and revolving credit accounts, can have a positive impact on an individual’s credit score. This diverse credit mix demonstrates a well-rounded approach to credit management and can enhance a person’s creditworthiness in the eyes of lenders. It reflects a balanced and responsible approach to handling various forms of credit, contributing to a stronger credit score overall.

Diverse credit management, when combined with responsible credit use and a solid credit history, forms the bedrock of a robust and healthy credit score, providing individuals with greater financial opportunities and flexibility in the long run.

Key Strategies for Improving Your Credit Score

Now that you understand the importance of having a strong credit score, it’s time to dive into the key strategies for improving it. By implementing these methods, you can take control of your financial future and pave the way for greater opportunities.

On-time payments: The backbone of your credit score

With payment history accounting for approximately 35% of your credit score, making on-time payments is absolutely crucial. Missing even one payment can have a significant negative impact, so it’s essential to stay organized and ensure that all of your bills are paid by their due dates. Setting up automatic payments or reminders can help you stay on track and avoid any unnecessary blemishes on your credit report.

Additionally, consistently making on-time payments demonstrates to lenders that you are a responsible borrower, which can ultimately boost your credit score and open doors to better interest rates and loan terms in the future.

Credit utilization: Finding the sweet spot

To optimize your credit score, it’s important to strike a balance when it comes to your credit utilization ratio. This ratio measures the amount of credit you are using compared to the total amount available to you. Ideally, you should aim to keep your utilization below 30% to show that you are using credit responsibly and not overextending yourself.

Utilization plays a significant role in determining your creditworthiness, so keeping your balances low and avoiding maxing out your credit cards can have a positive impact on your overall credit score and financial well-being.

By managing your credit utilization effectively, you can demonstrate discipline and responsibility, which are key factors in building and maintaining a strong credit profile.

Managing existing debt: Strategies for reduction

Your existing debt can significantly impact your credit score, particularly in terms of your credit utilization and payment history. By creating a debt reduction plan and prioritizing high-interest accounts, you can gradually decrease your outstanding balances and improve your creditworthiness over time.

Any effort to pay down debt can have a positive impact on your credit score and financial stability, so developing a strategic approach to manage and reduce your debt is essential for long-term success.

Limiting hard inquiries

Hard inquiries occur when you apply for new credit, and they can have a temporary negative impact on your credit score. Any unnecessary or excessive credit applications can signal financial strain or irresponsible behavior to lenders, potentially lowering your credit score and hampering your ability to access favorable credit options.

As a result, it’s crucial to be selective and mindful when applying for new credit, only pursuing opportunities that are truly necessary and align with your financial goals. By limiting hard inquiries, you can protect your credit score and maintain a positive financial reputation.

Advanced Techniques for Credit Score Maintenance

Keep your credit score in top shape with these advanced techniques for credit score maintenance:

- Periodic reviews of your credit report: It’s important to regularly review your credit report to ensure all information is accurate and up to date. By doing so, you can identify any errors or discrepancies and take action to rectify them.

- Navigating credit report errors: Understanding how to navigate credit report errors is crucial for maintaining a healthy credit score. By knowing the process for disputing errors, you can effectively address any inaccuracies that may be negatively impacting your score.

- Strategies for aging your accounts: Implementing strategies for aging your accounts can positively impact your credit score over time. By strategically managing the age of your credit accounts, you can demonstrate a strong credit history and improve your overall creditworthiness.

Techniques for Periodic reviews of your credit report

Regularly reviewing your credit report allows you to stay proactive in identifying any discrepancies or errors that may be impacting your credit score. By monitoring your report on a consistent basis, you can catch any issues early on and take the necessary steps to address them, thereby maintaining a strong credit profile.

Report on Navigating credit report errors

When it comes to credit report errors, staying informed and understanding the dispute process is key. By being proactive in addressing any inaccuracies on your credit report, you can prevent potential negative effects on your credit score and ensure that lenders are viewing an accurate representation of your creditworthiness.

Credit report, errors, dispute process

On Strategies for aging your accounts

On-going maintenance of the age of your credit accounts is essential for credit score health. By employing strategies that focus on increasing the average age of your credit accounts, you can demonstrate responsible credit management and boost your credit score over time.

Maintenance, aging accounts, responsible credit management

Life Situations and Your Credit Score

Not all life situations are under your control, but they can still impact your credit score. Understanding how different events in your life can affect your credit score is crucial for taking proactive steps to maintain a strong financial standing. Let’s explore some common life situations and how they relate to your credit score.

Dealing with financial setbacks

With the unpredictability of life, financial setbacks can occur at any time, such as unexpected medical expenses, job loss, or a natural disaster. These setbacks can lead to missed payments, increased credit card balances, and ultimately a lower credit score. It’s important to address these setbacks promptly and communicate with your creditors to find a solution, as letting them linger can have a detrimental impact on your credit score.

By taking proactive steps to address financial setbacks, such as creating a budget, seeking financial counseling, or negotiating payment plans with creditors, you can minimize the negative impact on your credit score and begin to rebuild your financial stability.

How major purchases affect your credit score

Life milestones such as buying a home, purchasing a new car, or taking on student loans can significantly impact your credit score. These major purchases often involve taking on substantial amounts of debt, which can increase your credit utilization and influence your credit score. Additionally, applying for multiple new lines of credit within a short time frame can result in multiple hard inquiries, further impacting your credit score.

Affecting your credit score and overall financial health, major purchases require careful consideration and planning. It’s important to weigh the benefits and consequences of these decisions and ensure that you can comfortably manage the additional financial responsibility without significantly impacting your credit score.

By making informed financial decisions and managing major purchases responsibly, you can minimize the negative impact on your credit score and maintain a strong financial foundation.

Marriage, divorce, and your credit

Credit can play a significant role in marriage and divorce, as it affects joint financial decisions and the division of assets and debts. When you marry someone with a different credit history, it can impact your joint credit applications and future financial plans. Similarly, during a divorce, the process of untangling joint finances and closing joint accounts can affect each party’s individual credit.

Credit implications should be carefully considered in these life situations, as they can have a lasting impact on your financial well-being. It’s essential to be proactive in managing credit within marriage and divorce, such as discussing financial goals with your partner and monitoring joint accounts to ensure both parties are working towards maintaining or improving their credit scores.

By actively managing your credit in the context of marriage and divorce, you can navigate these life events with minimal negative impact on your credit score and financial stability.

Beyond the Score: Building Financial Freedom

Despite the importance of a strong credit score, building financial freedom extends beyond just achieving a high number. It involves leveraging your credit score to unlock better financial opportunities and strategically planning for the future. By understanding the relationship between credit scores and personal finance, harnessing the benefits of a good credit score, and planning for the future with a strong credit foundation, individuals can pave the way to lasting financial freedom.

The relationship between credit scores and personal finance

Any individual seeking financial freedom must recognize the critical role that credit scores play in personal finance. A good credit score can open doors to favorable interest rates on loans, credit cards, and mortgages. It can also impact insurance premiums, rental applications, and even employment opportunities. Understanding the connection between credit scores and personal finance is crucial for making informed decisions and leveraging financial opportunities.

Leveraging a good credit score for better financial opportunities

Beyond the immediate benefits of favorable interest rates and access to credit, a good credit score can lead to positive long-term financial outcomes. With a high credit score, individuals can leverage their status to negotiate better terms on loans, secure higher credit limits, and qualify for premium rewards credit cards. Additionally, a good credit score can provide access to exclusive financial products and opportunities that are typically reserved for those with excellent credit.

Credit scores are not just numbers; they are powerful tools that can empower individuals to achieve financial goals and secure a more stable financial future. By managing credit responsibly and maintaining a good credit score, individuals can position themselves for greater financial success.

Planning for the future with a strong credit foundation

Strong financial planning involves establishing a solid credit foundation. A good credit score is a key component of this foundation, as it provides access to better borrowing opportunities, improved financial flexibility, and a safeguard against unexpected financial challenges. By strategically managing credit and continuing to build a strong credit history, individuals can pave the way for a more secure financial future.

Better financial planning starts with a strong credit foundation. Individuals who prioritize their credit health can enjoy greater flexibility and a wider range of financial options when it comes to achieving their financial goals.

Conclusion

Conclusively, building a strong credit score is an essential step towards achieving financial freedom and stability. By following the tips mentioned in this guide, individuals can take proactive steps to improve their creditworthiness and unlock more opportunities for financial success. It is important to remember that building a strong credit score takes time and discipline, but the rewards in the form of lower interest rates, better loan terms, and increased financial security make it well worth the effort. For more in-depth information, be sure to check out Unlocking Financial Freedom: The Ultimate Guide to Credit Repair.

Also Refer : Protecting Your Future – Understanding The Importance Of Insurance In Your Overall Financial Plan