Delve into the world of personal finance with these essential tips to help you save and invest your hard-earned money wisely. Understanding the intricacies of managing your finances is crucial for achieving financial stability and securing your future. By implementing these 10 essential personal finance tips, you can take control of your financial well-being and pave the way for a more secure and prosperous future.

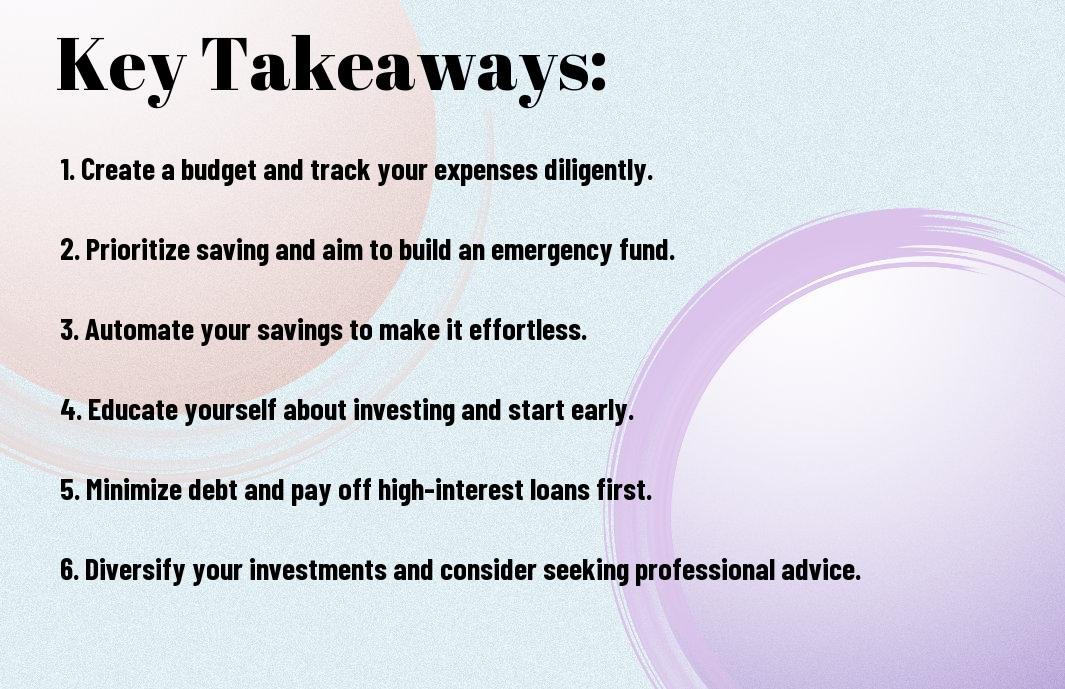

Key Takeaways:

- Create a Budget: Setting a budget is the first step towards managing your personal finances effectively. It helps you understand your income and expenses, making it easier to save and invest.

- Automate Your Savings: Setting up automatic transfers to a savings account ensures that you consistently save a portion of your income without having to think about it. This promotes a regular saving habit.

- Start Investing Early: The power of compound interest means that the earlier you start investing, the more time your money has to grow. It’s important to start investing for your long-term financial goals as soon as possible.

Understanding Your Financial Health

Some may find personal finance intimidating, but understanding your financial health is crucial for making informed decisions about your money. By assessing your current financial situation and recognizing the role of budgeting in wealth management, you can take the necessary steps to secure your financial future.

Assessing Your Current Financial Situation

Situation: Take a comprehensive look at your income, expenses, debts, and assets. Identify areas where you may be overspending or neglecting to save. Understanding your cash flow and net worth can provide valuable insights into your financial standing and help you set realistic goals for saving and investing.

The Role of Budgeting in Wealth Management

Financial: Budgeting plays a crucial role in wealth management by allowing you to track your spending, prioritize your financial goals, and allocate funds accordingly. It provides a framework for managing your expenses and saving for the future, ultimately leading to greater financial stability and security.

Health: It’s important to regularly review and adjust your budget to reflect changes in your financial situation and align with your long-term goals. Budgeting not only empowers you to live within your means, but it also serves as a tool for building wealth and achieving financial well-being.

Setting Realistic Financial Goals

Despite the challenges that may come with managing your personal finances, setting realistic financial goals is an essential step towards securing your financial future. By establishing clear objectives, you can effectively track your progress and stay motivated to save and invest wisely.

Short-Term vs Long-Term Goals

With your personal finances, it’s important to differentiate between short-term and long-term goals. Short-term goals typically involve immediate financial needs, such as building an emergency fund or paying off credit card debt. Long-term goals, on the other hand, may include objectives like saving for retirement or purchasing a home. By identifying and prioritizing these goals, you can allocate your resources effectively and stay focused on achieving each one.

Strategies for Achieving Your Financial Objectives

One effective strategy for achieving your financial objectives is to create a detailed budget that outlines your income, expenses, and savings targets. This will help you monitor your spending habits and make adjustments as needed to stay on track towards your goals. Additionally, consider automating your savings and investments to ensure consistent contributions and minimize the temptation to spend frivolously.

The key to successful goal-setting is to regularly review and reassess your financial objectives to ensure they align with your current circumstances and priorities. By staying adaptable and disciplined in your approach, you can make meaningful progress towards achieving your long-term financial security and stability.

The Art of Saving

To achieve financial success, it is crucial to master the art of saving. Saving money is the foundation of a solid financial future. It allows you to build an emergency fund, invest in your future, and achieve your long-term financial goals.

Effective Saving Techniques

Saving money requires discipline and strategic planning. One of the most effective techniques is to pay yourself first by setting aside a portion of your income before paying for other expenses. Creating a budget and tracking your expenses can help you identify areas where you can cut back and save more. Another effective technique is to set specific savings goals, whether it’s for a vacation, a down payment on a house, or retirement. By having clear goals, you can stay motivated and committed to saving.

Automating Your Savings for Success

Your financial success can greatly benefit from automating your savings. Set up automatic transfers from your checking account to your savings account each time you receive a paycheck. This ensures that you consistently save a portion of your income without having to manually move the money. By automating your savings, you take the decision-making out of the process and make it a habit, ultimately increasing your savings over time.

The key to successful automation is to treat your savings like a non-negotiable expense, just like your rent or mortgage. By prioritizing savings through automation, you are more likely to reach your financial goals and build a strong financial foundation for the future.

Dealing with Debt to Increase Savings

Saving while dealing with debt can be challenging, but it is essential for long-term financial success. Start by assessing your current debts and creating a plan to pay them off. Prioritize high-interest debts first to reduce the amount of interest you pay over time. Consider using the debt snowball or debt avalanche method to systematically pay off your debts. As you pay off your debts, allocate the money that was previously going towards debt payments to your savings, accelerating your progress towards financial security.

Techniques for dealing with debt involve managing your expenses, increasing your income, and staying committed to your financial goals. It may require making short-term sacrifices for long-term gain, but the freedom and peace of mind that come with being debt-free and having substantial savings are well worth the effort.

Smart Investing Principles

Keep your personal finance goals in mind when making investment decisions. Smart investing is essential for creating wealth and achieving financial independence. By following some key principles, you can increase your chances of success and minimize risk.

Understanding the Basics of Investing

Understanding the basics of investing is crucial for making informed decisions. Investing involves committing money to an asset with the expectation of earning a profit. It is essential to understand concepts such as risk and return, asset allocation, and investment diversification.

Types of Investments: Stocks, Bonds, and Mutual Funds

The types of investments include stocks, bonds, and mutual funds. Stocks represent ownership in a company, bonds are debt securities, and mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Assume that each type of investment carries a different level of risk and potential return.

| Investment Type | Key Characteristics |

| Stocks | Ownership in company, potential for high return, high risk |

| Bonds | Debt securities, fixed interest payments, lower risk than stocks |

| Mutual Funds | Diversified portfolio, managed by professionals, moderate risk |

For instance, when investing in stocks, you could potentially earn high returns but also face a higher level of risk. Assume that bonds offer a more conservative option with lower returns but lower risk as well.

Risk vs. Reward: Finding Your Comfort Zone

On the risk-reward spectrum, understanding your comfort zone is crucial. Risk refers to the uncertainty of investment returns and potential for financial loss, while rewards represent the potential gain from an investment.

It is important to assess your risk tolerance, investment objectives, and time horizon when considering different investment options, ensuring they align with your financial goals.

Diversification and Its Importance

Investments should be diversified across different asset classes to spread risk and optimize returns. Diversification involves investing in various securities to reduce exposure to any single asset or risk.

This strategy helps mitigate the impact of volatility and market fluctuations on your overall investment portfolio. This approach can lead to more consistent returns and reduce the impact of market downturns on your investment.

Retirement Planning Essentials

Not thinking about retirement planning early enough is a common mistake that many individuals make. It’s essential to start planning for retirement as early as possible in order to take advantage of the power of compounding. One of the most powerful tools for building wealth over the long term is the compounding of investment returns. By starting to save and invest for retirement early, you can harness the power of compounding to significantly grow your savings over time.

Early Planning and the Power of Compounding

One important strategy for retirement planning is to start as early as possible. The earlier you start saving and investing, the more time your money has to grow through the power of compounding. This means that the returns generated by your investments are reinvested to generate even more returns, creating a snowball effect on your wealth accumulation over time.

Retirement Accounts: 401(k)s and IRAs

Planning for retirement involves understanding the different retirement account options available, such as 401(k)s and IRAs. Planning to contribute to these accounts can provide significant tax advantages and help accelerate your retirement savings. By contributing to a 401(k) through your employer or an IRA on your own, you can take advantage of tax-deferred or tax-free growth on your investments, allowing your savings to grow more rapidly over time.

Planning, Retirement Accounts, 401(k)s, IRAs, savings

Protecting Your Wealth

For many people, building and accumulating wealth is a significant achievement, but it is equally important to protect and preserve it. In this chapter, we will discuss essential strategies to shield your hard-earned wealth and ensure financial security for the future.

The Necessity of an Emergency Fund

Your financial well-being should always be safeguarded from unexpected expenses or income loss. Building an emergency fund is crucial to protect yourself from potential financial hardships, such as medical emergencies, job loss, or unexpected home repairs. By having a pool of savings set aside for unforeseen circumstances, you can avoid falling into debt or liquidating long-term investments during times of crisis. Aim to accumulate at least three to six months’ worth of living expenses in your emergency fund to provide a safety net for any unforeseen financial challenges.

Insurance Products as a Safety Net

The right insurance products can serve as a valuable safety net to protect your wealth from risks and uncertainties. Whether it’s health, life, disability, or property insurance, these products can mitigate potential financial losses resulting from unforeseen events. Insurance provides peace of mind, knowing that you and your loved ones are financially protected in the event of illness, injury, or loss. It is essential to carefully assess your insurance needs and invest in comprehensive coverage that aligns with your specific circumstances and financial goals.

Protecting your wealth with insurance products offers a layer of security that is invaluable in maintaining financial stability and protecting your assets from unexpected events. Choosing the right insurance policies can be a critical component of your overall wealth protection strategy.

Estate Planning and Will Creation

With estate planning and will creation, you can ensure that your wealth is distributed according to your wishes and provide financial security for your loved ones. Estate planning encompasses various components such as creating a will, establishing trusts, and appointing guardians for minor children. Developing a comprehensive estate plan allows you to minimize estate taxes and avoid potential legal disputes among heirs, ensuring a smooth transfer of assets to the next generation.

To effectively protect your wealth, it is essential to engage in comprehensive estate planning with the guidance of legal and financial professionals. Establishing a clear plan for the distribution of your assets can prevent confusion and potential conflict among beneficiaries, ultimately safeguarding your wealth for the benefit of your family and future generations.

Continuous Learning and Adaptation

Your journey towards financial freedom and security is an ongoing process that requires continuous learning and adaptation. By staying informed about financial markets, adapting to life changes, knowing when to seek professional financial advice, and summarizing key personal finance tips, you can effectively navigate the complexities of personal finance and make informed decisions for your future financial well-being.

Staying Informed About Financial Markets

About keeping yourself informed about the latest trends and developments in financial markets is crucial for making informed investment decisions. Whether it’s staying updated on stock market performances, changes in interest rates, or emerging investment opportunities, staying informed can help you make proactive choices to grow your wealth and mitigate risks.

Adapting to Life Changes and Their Financial Implications

The ability to adapt to life changes and understand their financial implications is essential for maintaining financial stability. Whether it’s marriage, parenthood, job changes, or unexpected emergencies, understanding the implications of these changes and adjusting your financial plan accordingly can help you stay on track towards your financial goals. Implications such as these can impact your savings, investments, and overall financial well-being.

Financial advisors can provide valuable insights and expertise in areas where you may lack knowledge or experience. Seeking professional financial advice when making major financial decisions, navigating complex investment opportunities, or planning for retirement can provide you with personalized guidance and expertise tailored to your unique financial situation. Financial advisors can help you make informed decisions and optimize your financial strategies for long-term success.

Summary of Key Personal Finance Tips

Adapting to the ever-changing landscape of personal finance is crucial for long-term success. By staying informed about financial markets, adapting to life changes, knowing when to seek professional financial advice, and summarizing key personal finance tips, you can build a solid foundation for your financial future. These key tips include

-

- budgeting

- saving and investing

- managing debt

-

- protecting your assets

Though the process may seem daunting at times, the rewards of financial security and independence are well worth the effort.

Encouragement for Your Financial Journey

Learning about personal finance may seem daunting at first, but with each step forward, you are empowering yourself to take control of your financial future. For instance, facing the challenges and embracing the opportunities that come with adapting to life changes can lead to greater financial resilience and success in the long run.

Also Read : The Ultimate Guide To Understanding Loans – Types, Rates, And How To Borrow Wisely

FAQs

Q: Why is personal finance important?

A: Personal finance is important because it helps individuals manage their money effectively, plan for the future, and achieve their financial goals. By understanding the basics of personal finance, individuals can avoid financial pitfalls and build wealth over time.

Q: What are the key components of personal finance?

A: The key components of personal finance include budgeting, saving, investing, managing debt, insurance, and retirement planning. These elements work together to help individuals achieve financial stability and security.

Q: How can I create a budget to manage my finances?

A: To create a budget, start by tracking your income and expenses. Then, allocate funds for essential expenses, such as housing, food, and transportation, as well as for savings and debt payments. Stick to your budget and make adjustments as needed.

Q: What are some effective saving strategies?

A: Effective saving strategies include setting specific savings goals, automating savings contributions, cutting unnecessary expenses, and taking advantage of high-interest savings accounts or investment opportunities. Saving consistently, even small amounts, can lead to significant financial growth over time.

Q: How can I start investing for the future?

A: Start investing for the future by educating yourself about investment options, setting clear investment goals, and determining your risk tolerance. Consider diversifying your investments across different asset classes and seeking professional advice if needed.

Q: What is the significance of managing debt in personal finance?

A: Managing debt is crucial in personal finance because excessive debt can hinder financial progress and lead to financial stress. Prioritize paying off high-interest debt, such as credit card debt, and avoid taking on additional debt whenever possible.

Q: Why is it important to have insurance as part of personal finance planning?

A: Insurance provides protection against unexpected events, such as medical emergencies, accidents, or natural disasters, that can have significant financial implications. Health insurance, life insurance, and property insurance are essential components of a comprehensive personal finance plan.

Q: How can I plan for retirement and why is it important?

A: Planning for retirement is important to ensure financial security during the later stages of life. Start early, contribute regularly to retirement accounts such as 401(k) or IRA, and consider consulting a financial advisor to create a retirement plan tailored to your individual needs and goals.