Burgeoning your Personal finance literacy is an essential component of achieving long-term economic success. Understanding how to make money work for you is a critical skill in today’s ever-changing economy. In this blog post, we will discuss the most important principles of personal finance and how you can use them to create a solid foundation for your financial future. We will also cover some dangerous pitfalls to avoid and highlight positive strategies to help you achieve your financial goals. By mastering personal finance, you can take control of your financial destiny and secure a brighter future for yourself and your loved ones.

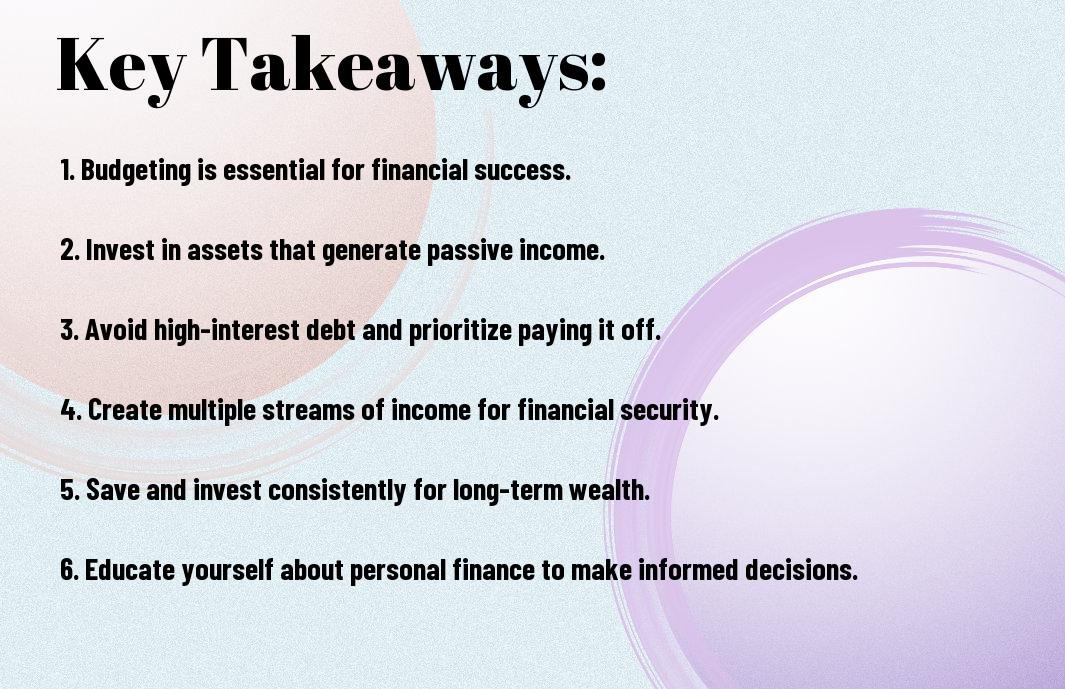

Key Takeaways:

- Financial literacy is essential: Understanding money management, budgeting, and investing is crucial for achieving financial success and security.

- Create a comprehensive financial plan: By setting financial goals, creating a budget, and building an emergency fund, individuals can take control of their money and make it work for them.

- Invest in your future: Utilize tools like retirement accounts and investment vehicles to grow wealth and secure a comfortable future.

Understanding Your Financial Situation

Clearly, understanding your current financial situation is the first step towards mastering personal finance. It is essential to have a clear picture of your assets, liabilities, income, and expenses in order to make informed decisions and take control of your financial future.

Assessing Your Current Financial Health

Your first step in mastering personal finance is to assess your current financial health. Take stock of your assets, including savings, investments, and property, as well as your liabilities, such as debts and mortgages. Calculate your net worth to understand where you stand financially. Additionally, analyze your monthly income and expenses to gain insight into your spending habits and identify areas for improvement.

Setting Financial Goals

The next crucial step in mastering personal finance is setting financial goals. This involves defining both short-term and long-term objectives that align with your values and aspirations. Whether it’s building an emergency fund, paying off debt, or saving for retirement, clear and specific financial goals will provide direction and motivation for your money management efforts.

Financial goals should be SMART – specific, measurable, achievable, relevant, and time-bound. Setting SMART financial goals ensures that they are realistic and attainable, and allows you to track your progress effectively. This approach will help you stay focused and disciplined in working towards your financial aspirations.

The Role of Budgeting in Personal Finance

Goals are the foundation of effective budgeting in personal finance. Creating a budget involves allocating your income towards essential expenses, savings, and discretionary spending in line with your financial goals. A well-planned budget empowers you to take control of your money and avoid overspending, allowing you to make intentional and informed financial decisions.

Your budget should reflect your financial goals and priorities, providing a roadmap for managing your finances. Through budgeting, you can track your income and expenses, identify areas of overspending or undersaving, and make necessary adjustments to achieve your financial objectives.

In the chapter ‘Savings Strategies’, we will explore various techniques to help you build a strong financial foundation.

In the chapter ‘Savings Strategies’, we will explore various techniques to help you build a strong financial foundation.

Savings Strategies

are crucial in mastering personal finance, as they pave the way for financial security and future investments.

The Basics of Saving Money

Savings is the portion of your income that you set aside for future use, rather than spending it immediately. It is the fundamental building block of personal finance, allowing you to accumulate funds for emergencies, investments, and long-term goals. Establishing a saving habit, no matter how small, is essential for financial stability and growth.

Also Read:- Unlocking The Path To Financial Freedom – Tips For Building A Strong Credit Score

Consistently setting aside a portion of your income, whether it’s 10% or 30%, creates a safety net and sets the stage for future financial success. Saving regularly and consistently will help you build a substantial sum over time through the power of compound interest.

Types of Savings Accounts and Their Benefits

BasicsThe type of savings account you choose can significantly impact your ability to save effectively. It’s essential to consider the interest rate, minimum balance requirements, and fees when selecting a savings account. This is your first step towards harnessing the power of your money and making it work for you, rather than against you.

| Type of Savings Account | Benefits |

|---|---|

| Traditional Savings Account | Easy access to funds |

| Certificate of Deposit (CD) | Higher interest rates |

| Money Market Account | Higher interest rates and limited check-writing capabilities |

| High-Yield Savings Account | Competitive interest rates |

| Individual Retirement Account (IRA) | Tax advantages for retirement savings |

This variety of options allows you to choose accounts that align with your short-term and long-term financial goals. Carefully selecting the right type of savings account can maximize the growth potential of your savings.

Smart Savings Habits for Long-term Success

Creating an automatic savings plan is a smart way to ensure you consistently set aside a portion of your income. By automating your savings, you prioritize paying yourself first and remove the temptation to spend the money elsewhere.

Saving your windfalls, such as tax refunds, work bonuses, and unexpected cash gifts, can significantly boost your savings without impacting your regular budget. By treating windfalls as extra boosts to your savings, you can accelerate your progress towards financial goals.

Emergency Funds: How Much and How to Start

Smart savings strategies always include building an emergency fund to cover unexpected expenses. Financial experts recommend setting aside three to six months’ worth of living expenses in an easily accessible account. This fund acts as a safety net, providing financial security in cases of job loss, medical emergencies, or unexpected home repairs.

Emergency funds shield you from having to rely on high-interest debt or liquidating long-term investments during challenging times, ensuring that your financial progress remains uninterrupted.

Investment Essentials

Keep in mind that mastering personal finance involves understanding the essential principles of investment. Whether you are a beginner or an experienced investor, it is crucial to have a solid grasp of the key elements that drive successful investment strategies. For a comprehensive guide on personal finance strategies, you can refer to Mastering Personal Finance: Strategies for Financial Success.

One of the most important aspects of investment is diversification. By spreading your investments across a variety of assets, you can reduce the risk associated with any single investment. Asset allocation is also critical, as it involves distributing your investments among different asset classes such as stocks, bonds, and real estate to optimize risk and return.

It’s essential to understand the power of compounding. By reinvesting your investment earnings, you can accelerate your wealth accumulation over time. However, it’s important to be wary of overconfidence and impulsiveness in investment decision-making, as these traits can lead to dangerous financial mistakes.

Another positive detail is the importance of long-term perspective. Successful investors understand that patience and discipline are key to achieving financial goals. Consistent saving and disciplined investing over the long term can lead to wealth accumulation and financial security.

FAQ

Q: What is personal finance?

A: Personal finance refers to the management of an individual’s financial resources, including budgeting, saving, investing, and managing debt, with the aim of achieving financial security and long-term financial goals.

Q: Why is mastering personal finance important?

A: Mastering personal finance is important because it allows individuals to take control of their financial future, create wealth, and achieve financial independence. It also provides a sense of security and peace of mind.

Q: How can I start mastering personal finance?

A: You can start mastering personal finance by creating a budget, setting financial goals, tracking your expenses, building an emergency fund, and educating yourself about investing and retirement planning.

Q: What are the key principles of personal finance?

A: The key principles of personal finance include living within your means, saving and investing for the future, avoiding debt, and regularly reviewing and adjusting your financial plan.

Q: How can I make my money work for me?

A: You can make your money work for you by investing in assets that generate passive income, such as stocks, real estate, or business ownership. Additionally, maximizing returns on savings and minimizing expenses can help your money work harder for you.

Q What are the common mistakes to avoid in personal finance?

A: Common mistakes to avoid in personal finance include overspending, taking on too much debt, not saving for emergencies or retirement, and neglecting to diversify investments.

Q: How can I stay motivated to master personal finance?

A: You can stay motivated by regularly reviewing your financial goals, tracking your progress, celebrating small victories, and seeking support from like-minded individuals or financial professionals.