Financial : It’s imperative to find innovative ways to manage your finances to ensure a stable and secure future. With the rising cost of living and unexpected expenses, it’s crucial to have a solid plan in place to protect your financial well-being. In this blog post, we will discuss key strategies to help you save money and improve your overall financial health.

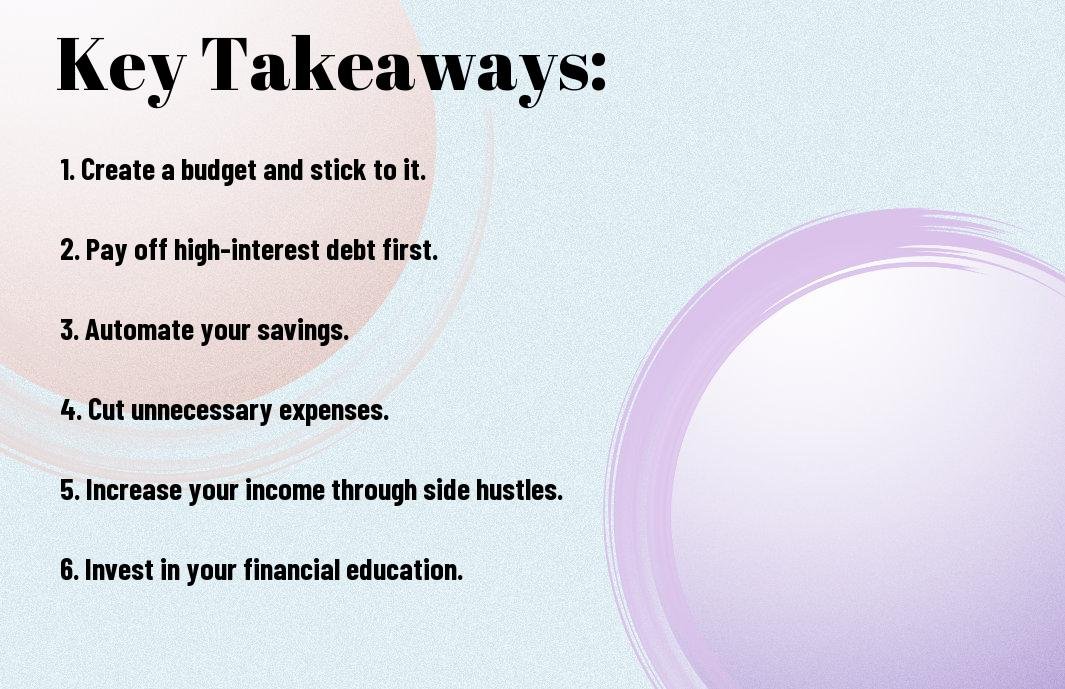

Key Takeaways:

- Build an emergency fund: Having a savings cushion for unexpected expenses can prevent you from going into debt and help you maintain financial stability during challenging times.

- Automate your savings: Setting up automatic transfers to a savings account can help you save consistently without having to think about it, making it easier to reach your financial goals.

- Reduce unnecessary expenses: Review your lifestyle and cut out non-essential spending, such as dining out frequently or subscribing to multiple streaming services, to free up extra money for savings and investments.

Understanding Your Finances

Any successful financial plan starts with a clear understanding of your current financial situation. This involves knowing your income, expenses, debt, and savings. By gaining a comprehensive understanding of your finances, you can make informed decisions and take control of your financial well-being.

Creating a Personal Budget

Budgeting is a fundamental tool for managing your finances effectively. It allows you to track your income and expenses, prioritize your spending, and avoid unnecessary debt. Start by listing all your sources of income and then deducting your fixed expenses such as rent, utilities, and loan repayments. Allocate a portion of your income to savings and set limits on discretionary spending. Review your budget regularly and make adjustments as needed to ensure it reflects your financial priorities.

Avoid overspending and impulse buying to adhere to your budget, which will help you achieve your financial goals. Seek opportunities to reduce your expenses and consider generating additional income through part-time work or a side hustle. Effective budgeting is the foundation for a healthy financial future.

The Significance of an Emergency Fund

An emergency fund is a crucial component of a solid financial plan. It provides a safety net in case of unexpected events such as medical emergencies, car repairs, or job loss. By setting aside a portion of your income regularly, you can build up a reserve to cover emergency expenses without compromising your long-term financial security.

Areas of focus for an emergency fund include healthcare costs, home and car maintenance, and living expenses during unemployment or unforeseen circumstances. Having an emergency fund in place provides peace of mind and financial stability during challenging times.

Smart Saving Strategies

Your financial health depends on your ability to save money. Implementing smart saving strategies can help you build a solid financial foundation for the future. By making small changes to your saving habits, you can make a big impact on your overall financial well-being.

Automating Your Savings

Saving money can be as simple as setting up automatic transfers from your checking account to your savings account. By automating your savings, you can ensure that a portion of your income goes directly into savings without you having to think about it. This method can help you build a substantial savings balance over time, without having to rely on willpower alone. By making it a regular habit, you’ll be able to grow your savings without feeling the pinch.

Cutting Unnecessary Expenses

Expenses can quickly add up and eat into your savings. Cutting unnecessary expenses is a key strategy for boosting your financial health. Start by reviewing your monthly subscriptions and services to see if there are any you can eliminate or downgrade. Additionally, consider shopping around for better deals on your regular expenses, such as utilities, insurance, and groceries. Reducing these costs can free up more money to put towards your savings goals.

Your ability to identify and reduce unnecessary expenses will play a crucial role in your financial success. By making small adjustments to your spending habits, you can make a big impact on your overall financial well-being.

Increasing Your Income

For many people, finding ways to increase their income is the key to improving their financial health. Whether you’re looking to pay off debt, save for a big purchase, or simply have more breathing room in your budget, there are several smart strategies you can use to boost your earnings.

Side Hustles and Part-Time Jobs

Jobs and side hustles are a great way to increase your income without committing to a full-time job. Whether it’s freelancing, driving for a ride-sharing company, or working part-time at a retail store, these opportunities can provide a valuable supplement to your regular income. With advances in technology, there are now more options than ever for finding flexible, part-time work that can fit around your existing schedule.

With the gig economy and remote work becoming more prevalent, there are also opportunities to take on short-term projects and freelance assignments in a variety of fields. Whether you have a skill in writing, graphic design, or coding, there are platforms where you can market your talents and find freelance work.

Investing in Your Education and Skills

With the job market becoming increasingly competitive, investing in your education and skills can be a smart way to increase your earning potential. Whether it’s pursuing a certification in a specialized field or learning a new skill that’s in high demand, the right education and training can open up new career opportunities with higher earning potential.

Investing Wisely

Not sure where to start when it comes to investing? 9 Ways to Improve Your Finances in 2024 is a great resource to get you on the right track. Investing wisely is crucial for building long-term financial security and achieving your financial goals.

Understanding Different Investment Options

Understanding different investment options is vital for making informed decisions about where to put your money. Whether you’re considering stocks, bonds, mutual funds, or real estate, each option comes with its own set of risks and potential rewards. It’s important to do thorough research and consider seeking professional advice to ensure you’re making the best choices for your financial situation.

With the constantly changing market conditions, staying informed about the latest investment trends and opportunities is key to making smart investment decisions.

Risk Management and Diversification

Investment risk management and diversification are essential strategies for protecting your investment portfolio. Investment risks are inherent in any investment, but by diversifying your portfolio across different asset classes and industries, you can manage and reduce the overall risk. Diversification helps to spread the risk, so if one investment performs poorly, others may still provide positive returns, helping to cushion the overall impact.

With the right risk management and diversification, you can protect your investments from potential downturns in the market and increase the likelihood of long-term success.

Smart Use of Credit

Keep your credit card spending in check by only using it for essential purchases, and making sure to pay off the balance in full each month. This will help you avoid high interest charges and prevent yourself from falling into a cycle of debt.

Managing Credit Card Debt

Credit card debt can quickly spiral out of control if not managed properly. It is crucial to make more than the minimum monthly payments to avoid accumulating interest and paying off the debt for years. Consider transferring your high-interest balances to a card with a lower interest rate, or consolidating your debts with a personal loan to make repayment more manageable. A proactive approach to managing credit card debt is essential for maintaining a healthy financial status.

Understanding Credit Scores and Reports

Traps such as missing payments and carrying high credit card balances can have a negative impact on your credit score, making it difficult to secure loans and obtain favorable interest rates. Keep an eye on your credit report to spot any discrepancies or errors that may be affecting your score, and take steps to correct them.

Understanding your credit score and report is essential for making informed financial decisions. Regularly checking your credit report and taking steps to improve your credit score can lead to better financial opportunities and long-term stability.

Planning for the Future

Despite the many uncertainties of life, it’s crucial to plan for the future. Setting financial goals and retirement planning are key components to ensuring your long-term financial health. By taking proactive steps now, you can secure a more stable and comfortable future for yourself and your loved ones.

Setting Financial Goals

Goals provide a roadmap for your financial journey. Whether it’s saving for a down payment on a home, paying off debt, or building an emergency fund, setting clear and achievable financial goals will help you stay focused and motivated. Start by identifying your short-term, mid-term, and long-term financial objectives. Be specific and realistic in setting these goals, and regularly review and adjust them as needed.

Retirement Planning

Setting aside funds for retirement is a critical part of financial planning. With life expectancy increasing, it’s essential to start early and contribute regularly to retirement accounts. Consider working with a financial advisor to develop a comprehensive retirement plan that aligns with your lifestyle and long-term objectives. Many employers offer retirement savings programs, such as 401(k)s, with matching contributions, which can significantly boost your retirement nest egg.

Roadmap: As you plan for retirement, consider factors such as inflation, healthcare costs, and potential market fluctuations. Diversifying your retirement portfolio and staying informed about changes in retirement legislation are also crucial for a secure retirement.

Protecting Your Wealth

Now, that you’ve built up your wealth, it’s important to protect it. There are several ways to safeguard your finances, including insurance and estate planning.

Insurance as a Financial Tool

Insurance is a crucial financial tool that can protect you and your family from unforeseen events. Whether it’s health insurance, life insurance, or property insurance, having the right coverage can prevent financial devastation in the face of emergencies. It’s important to carefully assess your insurance needs and make sure you have adequate coverage for all aspects of your life.

Estate Planning and Wills

To ensure that your wealth is passed on according to your wishes, estate planning and creating a will are essential. These legal documents dictate how your assets will be distributed after your passing, and can also include provisions for guardianship of children, healthcare directives, and more. It’s crucial to consult with a professional to establish a comprehensive estate plan that aligns with your goals and protects your legacy.

For instance, if you have specific assets that you want to leave to certain family members or charitable organizations, a will can outline these details clearly, ensuring that your wishes are fulfilled.

Final Words

From above, it is clear that there are numerous smart ways to save money and improve your financial health. By implementing the tips and strategies provided in this article, you can take control of your finances and work towards a more secure future. It’s important to remember that saving money and building financial stability is a journey that requires consistency and discipline. By making smart financial decisions and prioritizing your long-term goals, you can achieve financial success and peace of mind.

Also Refer : 10 Essential Personal Finance Tips To Help You Save And Invest

FAQs

Q: What are some smart ways to save money?

A: Smart ways to save money include creating and sticking to a budget, automating savings, shopping for better deals, and avoiding unnecessary expenses.

Q: How can I boost my financial health?

A: You can boost your financial health by paying off debt, investing in a retirement fund, building an emergency fund, and making smart spending decisions.

Q: What is the importance of saving money?

A: Saving money is important because it provides financial security, helps in achieving financial goals, and provides a cushion for unexpected expenses.

Q: What are some effective budgeting tips?

A: Effective budgeting tips include tracking your expenses, setting realistic goals, prioritizing saving and debt repayment, and regularly reviewing and adjusting your budget.

Q: How can I reduce my monthly expenses?

A: You can reduce your monthly expenses by cutting out unnecessary subscriptions, negotiating bills, meal planning to reduce food costs, and finding cheaper alternatives for common expenses.

Q: Is it important to have an emergency fund?

A: Yes, having an emergency fund is important as it provides a financial safety net for unexpected expenses, such as medical bills or car repairs, and helps prevent taking on high-interest debt in times of need.

Q: What are some long-term strategies for saving money?

A: Long-term strategies for saving money include investing in stocks and retirement accounts, purchasing life and health insurance, and pursuing additional education or professional development to increase earning potential.