Earn yourself a place among the financially savvy by mastering the art of building an excellent credit score. Your credit score is one of the most critical factors in achieving financial success. In this ultimate guide, we will explore the most important steps and strategies you can implement to positively impact and build your credit score.

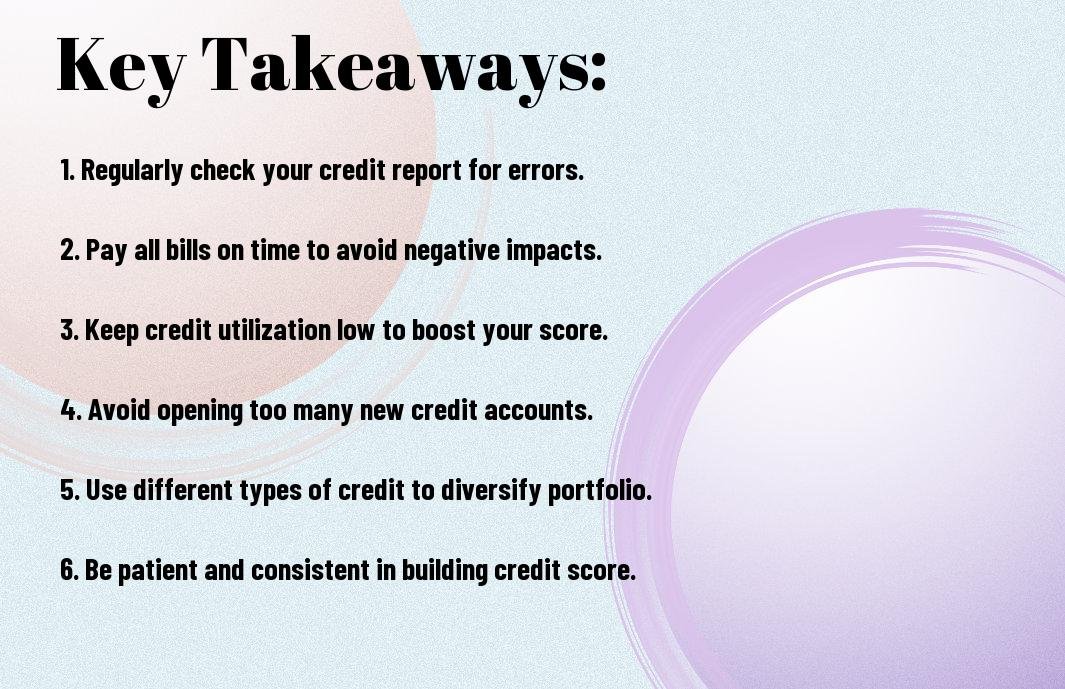

Key Takeaways:

- Understanding Credit Score Metrics: Learning about the factors that influence credit scores, such as payment history, credit utilization, length of credit history, new credit, and types of credit, is essential for building an excellent credit score.

- Effective Credit Building Strategies: The guide outlines practical tips and strategies for improving credit scores, including making on-time payments, maintaining low credit card balances, and monitoring credit reports for errors.

- Long-Term Financial Success: By mastering the art of building an excellent credit score, individuals can open doors to better financial opportunities, such as lower interest rates on loans, higher credit limits, and access to premium financial products.

Understanding Your Credit Score

Even with its complexity, your credit score is a crucial aspect of your financial health. It affects your ability to borrow money, the interest rates you’ll pay, and even your insurance premiums. To truly master the art of building an excellent credit score, you need to understand the ins and outs of this crucial financial metric. For an in-depth guide on building a strong credit score, check out Mastering Trade Lines “A Guide to Building Credit and Financial Success”.

What is a Credit Score?

Score a credit score is a three-digit number that represents your creditworthiness. It is calculated based on your credit history, including your payment history, amount of debt, length of credit history, new credit, and types of credit used. Lenders use this score to determine the risk of lending to you and the interest rate you will be charged.

Your credit score is a numeric representation of your credit risk at a specific point in time. It helps lenders assess how likely you are to repay your debts on time, which ultimately influences their decision to approve or deny your credit application.

Components of a Credit Score

Understanding the components of your credit score is essential for improving it. The main factors that make up your credit score include payment history, credit utilization, length of credit history, new credit inquiries, and the types of credit accounts you have. To improve your credit score, you need to pay attention to these components and make responsible financial decisions.

To increase your credit score, it’s vital to focus on maintaining a history of on-time payments, keeping credit card balances low, and managing a healthy mix of credit accounts. These factors play a significant role in determining your creditworthiness and overall financial health.

How Credit Scores Are Calculated

One of the most commonly used credit scoring models is the FICO score, which ranges from 300 to 850. This scoring model evaluates the information in your credit report and assigns weights to various factors to calculate your score. Factors such as payment history, credit utilization, length of credit history, new credit, and types of credit used are all taken into account in the scoring process.

Your credit score affects many aspects of your life, including your ability to get a loan, the interest rates you’ll pay, and even your chances of getting hired for certain jobs. It’s important to understand the factors that go into calculating your credit score so that you can take steps to improve it.

Different Types of Credit Scores

For individuals seeking credit, it’s important to understand that there are multiple types of credit scores used by lenders and financial institutions. The most common types include the FICO Score, VantageScore, and specialized industry-specific scores. After all, each scoring model has its own criteria for evaluating creditworthiness and may produce different scores for the same individual.

- FICO Score: The most widely used credit scoring model, ranging from 300 to 850.

- VantageScore: Another popular scoring model, ranging from 300 to 850, developed by the three major credit bureaus.

- Industry-Specific Scores: These scores are tailored to specific industries, such as auto lending or mortgage lending, and may have different ranges and criteria.

- Custom Scores: Some lenders create their own proprietary scoring models to assess creditworthiness.

- Not all scores: These scores may also differ from the generic FICO or VantageScore used in most lending decisions.

For instance, a lender providing an auto loan may use a different credit scoring model than a credit card issuer. It’s crucial to be aware of the specific scoring model being used in any particular credit application. After all, understanding the type of credit score being utilized can provide valuable insights into the lending decision process and help you make informed financial choices.

Factors That Affect Your Credit Score

For individuals striving to improve their credit score, it’s important to understand the various factors that have an impact on this crucial financial metric. The following are the key components that can influence your credit score:

- Payment History

- Credit Utilization Ratio

- Length of Credit History

- Types of Credit in Use

- New Credit and Inquiries

Assume that each of these factors plays a significant role in determining your overall creditworthiness and ability to access favorable financial products.

Payment History

Factors such as late payments, accounts in collections, and bankruptcies directly impact your payment history. Lenders assess this to gauge an individual’s reliability in meeting their financial obligations. A consistent history of on-time payments is crucial for maintaining a healthy credit score.

Credit Utilization Ratio

Payment

Affecting your credit utilization ratio is the proportion of your available credit that you are using. This ratio significantly influences your credit score, being too high and too low can both have negative effects.

This vital component of your credit score is crucial in determining your overall financial health, as it reflects your ability to manage your existing credit responsibly while indicating your capacity to take on additional credit.

Length of Credit History

Score

This factor assesses how long you have been using credit, including the age of your oldest account, the average age of all your accounts, and the age of your newest account. A long and positive credit history reflects more favorably on your credit score.

This aspect of your credit history is particularly important as it provides lenders with a clearer understanding of your financial behavior over an extended period.

Types of Credit in Use

History

| Types of Credit | Description |

| Mortgage | Home loan |

| Auto loan | Vehicle financing |

| Credit cards | Revolving credit |

| Student loans | Educational financing |

| Personal loans | General purpose loans |

With a diverse range of credit types, lenders can gain better insights into your credit management skills. Recognizing and effectively managing different types of credit can positively impact your credit score.

New Credit and Inquiries

Length

The frequency and recency of new credit accounts and credit inquiries can have a significant impact on your credit score. Opening multiple new credit accounts in a short timeframe can be a red flag for lenders.

The number of recent credit inquiries on your report can also indicate financial distress or a potential lack of stability, which can lead to a negative impact on your credit score.

Strategies for Building Your Credit Score

Now that you understand the importance of building an excellent credit score, it’s time to dive into the specific strategies that will help you achieve this goal. By implementing the following tactics, you can proactively improve your credit score and set yourself up for financial success.

On-Time Payments

Score one of the most impactful factors in determining your credit score is making on-time payments. Consistently paying your bills by their due dates demonstrates responsible financial behavior and shows lenders that you are a reliable borrower. Setting up automatic payments or calendar reminders can help ensure that you never miss a payment, ultimately boosting your credit score.

Missing or late payments can significantly damage your credit score and hinder your ability to access favorable loan terms in the future. By prioritizing on-time payments, you can establish a solid foundation for your credit score and improve your financial standing.

Keeping Low Credit Card Balances

On top of making on-time payments, maintaining low credit card balances is crucial for building a high credit score. Keeping your credit utilization ratio (the amount of credit you’re using compared to your total credit limit) under control demonstrates responsible credit management. Aim to keep your balances well below your credit limits to show lenders that you are not overly reliant on credit.

Card balances that are close to or at the credit limit can signal financial distress to lenders, potentially resulting in a negative impact on your credit score. By keeping your credit card balances low, you can maintain a positive credit utilization ratio and solidify your financial standing.

Furthermore, keeping your credit card balances low can help you avoid accruing excessive interest charges, allowing you to save money in the long run and establish healthy spending habits.

Avoiding Unnecessary Credit Applications

Unnecessary credit applications can harm your credit score by triggering hard inquiries, which can cause a temporary dip in your score. Limiting your credit applications to essential needs and carefully considering each application can help you avoid unnecessary inquiries and their detrimental effects on your credit.

Building a reputation as a responsible borrower by being mindful of the number of credit applications you submit can strengthen your creditworthiness and position you as a favorable candidate for future credit opportunities.

Diversifying Your Credit Portfolio

One effective way to enhance your credit score is by diversifying your credit portfolio. This means utilizing different types of credit, such as installment loans and credit cards, to showcase your ability to manage various financial obligations. Having a well-rounded credit mix demonstrates your versatility in handling different forms of credit and can positively impact your credit score.

Payments made on different types of credit can showcase your financial responsibility and contribute to a more comprehensive credit history, ultimately strengthening your credit score and enhancing your overall financial profile.

Managing Your Debt-to-Income Ratio

Strategies to manage your debt-to-income (DTI) ratio play a crucial role in building and maintaining a strong credit score. Keeping your DTI ratio low by managing your debt responsibly can demonstrate to lenders that you can effectively handle your financial obligations without becoming overburdened by debt.

Applications for new credit should be approached cautiously, as they can increase your DTI ratio and potentially lower your credit score. By actively managing your DTI ratio, you can build a healthier financial profile and increase your creditworthiness in the eyes of lenders.

Repairing a Damaged Credit Score

After facing financial challenges, it’s essential to work on repairing a damaged credit score. A poor credit score can have a significant impact on your financial well-being, making it difficult to qualify for loans, obtain reasonable interest rates, or even secure housing or employment.

Identifying and Disputing Errors on Your Credit Report

Credit report errors can negatively affect your credit score. It’s crucial to regularly review your credit report for inaccuracies such as incorrect account information, late payments that were actually made on time, or accounts that don’t belong to you. If you identify any errors, promptly dispute them with the credit bureaus to have them corrected, as this can potentially improve your credit score.

It’s also vital to follow up with the credit bureaus to ensure the errors are resolved. Keeping thorough documentation of your correspondence and maintaining detailed records of all communication with the credit bureaus can strengthen your case and expedite the resolution process.

Settling Outstanding Debts

Damaged credit scores often result from outstanding debts. It’s crucial to take proactive steps to address these debts in order to improve your credit score. Negotiating with creditors to settle outstanding debts for less than the full amount can potentially improve your financial situation and ultimately enhance your credit score. By reaching a settlement agreement with your creditors, you may be able to remove negative remarks from your credit report and repair your credit score.

The process of negotiating and settling outstanding debts can be complex, but it’s a critical step toward financial recovery. In some cases, seeking professional help from credit counseling agencies or debt settlement companies may provide valuable guidance and support throughout the process.

Strategies for Dealing with Collections

Collections can severely damage your credit score and financial standing. It’s important to take proactive measures to address and resolve any accounts that have been sent to collections. Communication with collection agencies, negotiation of payment plans, and the possibility of settling for less than the full amount owed are strategies that can potentially mitigate the negative impact of collections on your credit score.

Rebuilding Credit Through Secured Credit Cards

Credit score rehabilitation often involves rebuilding credit through secured credit cards. These cards require a cash deposit to secure a credit line, making them a viable option for individuals with damaged credit. Making timely payments on a secured credit card can gradually improve your credit score, demonstrating responsible financial behavior to potential lenders.

Advanced Credit Score Optimization Techniques

Unlike the basic strategies for improving your credit score, advanced credit score optimization techniques require a deeper understanding of the factors that influence your credit score. By mastering these advanced techniques, you can elevate your credit score to new heights and unlock even greater financial opportunities.

- Timing Applications for New Credit

- Leveraging Credit Limit Increases

- Role of Credit Mix in Maximizing Credit Score

Advanced Timing Applications for New Credit

Advanced credit score optimization involves strategically timing your applications for new credit. Every time you apply for a new line of credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. By understanding the timing of these applications and spacing them out strategically, you can minimize the impact on your credit score and maximize your chances of approval.

The Leveraging Credit Limit Increases

The key to leveraging credit limit increases as an advanced credit score optimization technique is to regularly request increases on your existing credit accounts. By doing so, you can increase your available credit, decrease your credit utilization, and demonstrate responsible credit management to the credit bureaus. This can have a positive impact on your credit score over time.

With consistent and responsible use of credit, you can position yourself as a low-risk borrower in the eyes of lenders and credit scoring models, leading to further opportunities for favorable interest rates and higher credit limits.

Credit Mix in Maximizing Credit Score

Credit mix refers to the different types of credit accounts you have, such as credit cards, installment loans, and mortgages. Diversifying your credit mix can contribute to a more well-rounded credit profile and potentially boost your credit score. For advanced credit score optimization, consider diversifying your credit mix while maintaining responsible usage across all accounts.

This approach can showcase your ability to manage various types of credit responsibly, which can be a compelling factor for lenders and credit scoring models when evaluating your creditworthiness.

Maintaining Your Credit Score Long-Term

Keep maintaining a good credit score by following these key steps to ensure your financial success over the long term.

Monitoring Your Credit Report

LongTerm monitoring your credit report is essential for maintaining a healthy credit score. By regularly reviewing your credit report, you can identify and address any errors or suspicious activity that could negatively impact your score. Set up alerts or reminders to check your credit report at least once a year, and more frequently if possible.

It’s also important to monitor your credit report for any unauthorized inquiries or accounts, as this could be a sign of potential identity theft. By staying vigilant and catching these issues early, you can take actions to protect your credit score and overall financial well-being.

Understanding the Impact of Financial Actions on Your Credit Score

An understanding of how your financial actions can impact your credit score is crucial for maintaining long-term financial success. Each time you apply for new credit, make a late payment, or carry high balances on your credit cards, it can have a significant impact on your credit score. By understanding these actions and their potential consequences, you can make informed decisions to protect and improve your credit score.

Understanding the relationship between your financial behaviors and your credit score can empower you to take positive actions that will benefit your overall financial health. By making responsible financial choices, you can ensure that your credit score remains strong and supports your long-term goals.

Staying Informed on Changes to Credit Scoring Models

Actions staying informed about changes to credit scoring models is essential for maintaining a healthy credit score. Credit scoring models are continuously evolving, and staying informed about these changes can help you take the necessary steps to adapt and protect your credit score.

The ability to understand and respond to changes in credit scoring models can be the difference between a strong credit score and a declining one. By staying informed and proactive, you can take control of your financial future and maintain a positive credit profile.

Continuous Financial Education

Monitoring scoring your credit report and staying informed about changes to credit scoring models are just a few aspects of continuous financial education. By monitoring and educating yourself on these key elements, you can take control of your financial well-being and maintain a healthy credit score over the long-term.

Conclusion

To wrap up, mastering the art of building an excellent credit score is crucial for achieving financial success. By understanding the factors that impact your credit score and implementing the strategies outlined in this ultimate guide, you can take control of your financial future. Building and maintaining a strong credit score not only opens the door to better borrowing opportunities but also plays a crucial role in various aspects of your life, from securing a mortgage to accessing favorable insurance premiums.

Remember, improving your credit score is a journey that requires patience, diligence, and a deep understanding of how credit works. With the information and tools provided in this guide, you are well-equipped to take charge of your credit score and pave the way for a more secure and prosperous financial future. By mastering the art of building an excellent credit score, you can unlock a world of financial opportunities and set yourself on the path to long-term financial success.

Also Refer : How Insurance Can Protect Your Finances And Provide Peace Of Mind

FAQs

Q: Why is having an excellent credit score important?

A: Having an excellent credit score is important because it can impact your ability to secure loans, get better interest rates, and access favorable terms for financial products such as credit cards and mortgages. It also reflects your financial responsibility and can open up opportunities for better financial success.

Q: What factors influence a credit score?

A: Several factors influence a credit score, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Understanding these factors and how they impact your score is crucial in building and maintaining an excellent credit score.

Q: How can I improve my credit score?

A: You can improve your credit score by making timely payments, keeping credit card balances low, maintaining a long credit history, avoiding opening multiple new credit accounts at once, and having a good mix of credit types. It’s also important to regularly check your credit report for errors and address any discrepancies promptly.

Q: What are some common myths about credit scores?

A: Common myths about credit scores include the belief that checking your own credit report will lower your score (it won’t), that carrying a small balance on your credit cards will help your score (it’s better to pay the full balance), and that closing old accounts will improve your score (this can actually lower it).

Q: How long does it take to build an excellent credit score?

A: Building an excellent credit score takes time and consistent financial habits. While there’s no specific timeline, maintaining good credit habits over several years can lead to an excellent credit score. It’s important to be patient and stay disciplined in your financial decisions.

Q: What are the benefits of having an excellent credit score?

A: Having an excellent credit score can result in lower interest rates on loans and credit cards, better chances of loan approval, higher credit limits, and access to premium financial products. It can also be a factor in renting an apartment, getting insurance, and even landing a job in some industries.

Q: How can I maintain an excellent credit score once I’ve achieved it?

A: To maintain an excellent credit score, continue practicing good financial habits such as making timely payments, keeping credit card balances low, and avoiding unnecessary credit inquiries. Regularly monitor your credit report and address any issues that may arise. Additionally, be mindful of maintaining a healthy debt-to-income ratio and only applying for credit when necessary.