Obtaining financial freedom is a goal that many people aspire to achieve, yet not everyone knows the essential steps to take in order to make it a reality. In this blog post, we will delve into the most important and dangerous aspects of attaining financial freedom, as well as provide a roadmap to help you achieve your money goals. Whether you are looking to get out of debt, save for retirement, or build wealth, understanding the fundamental principles of financial freedom is essential for your financial success.

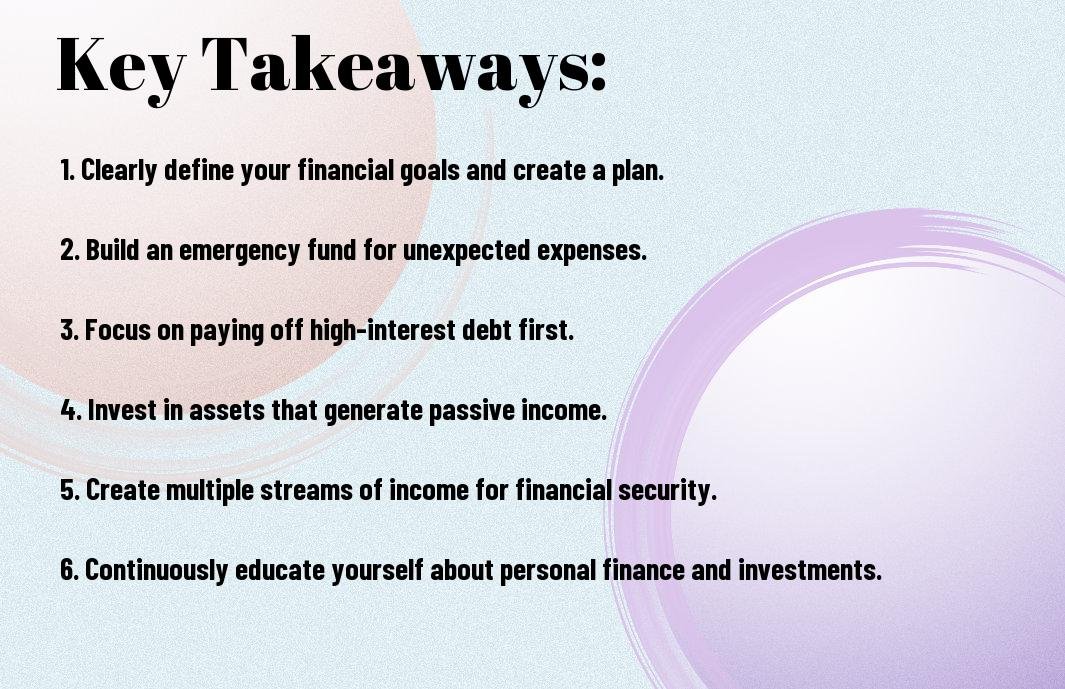

Key Takeaways:

- Develop a clear financial plan: Creating a structured plan is crucial to achieving financial freedom. This includes setting specific goals, creating a budget, and establishing a savings and investment strategy.

- Focus on increasing income and reducing expenses: Finding ways to increase your income, such as through side hustles or career advancements, while also cutting unnecessary expenses is key to building wealth and attaining financial freedom.

- Invest in yourself and your financial education: Continuously learning about personal finance, investing, and wealth-building strategies is essential. Investing in your education and skill development can lead to long-term financial success.

Setting Your Financial Goals

Assuming you are ready to take charge of your financial future, the first step is to set clear and achievable financial goals. Without a roadmap, it’s easy to get lost in the world of personal finance. By setting specific goals, you can focus your efforts and increase your chances of success.

Identifying Your Long-term and Short-term Goals

Long-term financial goals are those that you wish to achieve in the distant future, such as buying a home, retiring comfortably, or starting a business. Short-term financial goals, on the other hand, are the ones that you want to accomplish within the next few months or years, like paying off debt, building an emergency fund, or taking a vacation. It’s crucial to have a mix of both long-term and short-term goals to maintain balance and momentum in your financial journey.

Creating a Vision Board for Your Financial Future

One effective way to solidify your financial goals is by creating a vision board. This visual representation of your aspirations can serve as a powerful reminder of what you are working towards and can help you stay motivated and focused on your financial journey. By including images, quotes, and specific financial targets on your vision board, you can bring your goals to life and manifest them into reality.

Your vision board should reflect your most desired financial outcomes, whether it’s a debt-free lifestyle, a luxurious vacation, or a sizable retirement fund. By regularly visualizing and affirming these aspirations, you can harness the power of the law of attraction to speed up the realization of your financial goals.

Assessing Your Current Financial Situation

To achieve financial freedom, it is essential to start by assessing your current financial situation. Understanding where you stand financially will help you create a clear path towards your money goals. For more information on building your path to financial independence, check out Building Your Path to Financial Independence – Gordontredgold.

Calculating Your Net Worth

The first step in assessing your current financial situation is to calculate your net worth. This involves totaling up all of your assets and subtracting your liabilities. Assets can include savings, investments, and property, while liabilities may be debts, loans, or mortgages. This gives you a clear picture of your overall financial standing and a starting point to work from.

Understanding Your Income vs. Expenses

With a clear understanding of your net worth, it’s important to analyze your income and expenses. This involves tracking all sources of income and categorizing and totaling up your expenses. It’s crucial to identify how much money is coming in and where it is going out. This will help you determine areas where you can cut back on spending and potentially increase your savings.

Situation, expenses, income, financial standing, income vs. expenses, net worth

Identifying Financial Leaks and How to Plug Them

Assessing your financial leaks is crucial in achieving financial freedom. This involves identifying areas where you are overspending or wasting money unnecessarily. By plugging these leaks, you can increase your savings and put that money towards achieving your financial goals.

To achieve, financial leaks, overspending, plugging leaks, increasing savings, financial goals

Budgeting for Success

After setting your money goals, the next crucial step towards financial freedom is creating and sticking to a budget. A budget is the roadmap that will guide you towards achieving your financial goals and living within your means. In this chapter, we will explore the essential steps and strategies for effective budgeting to help you take control of your finances and achieve long-term financial success.

The Basics of Effective Budgeting

One of the fundamental principles of effective budgeting is tracking your income and expenses. Start by listing all your sources of income and then categorize your expenses into fixed and variable costs. Fixed expenses include rent, mortgage, insurance, and other regular payments, while variable expenses cover discretionary spending like entertainment and dining out.

One of the most important aspects of effective budgeting is creating a realistic spending plan that allows you to allocate your income towards essential expenses, savings, and discretionary spending while avoiding unnecessary debt accumulation.

Budgeting Tools and Resources

Budgeting tools and resources such as apps, spreadsheets, and financial planning software can be helpful in simplifying the budgeting process. These tools can automate expense tracking, provide insights into your spending habits, and help you stay on track towards your financial goals. Consider using tools like Mint, YNAB, or Excel to create and manage your budget effectively.

Basics of budgeting also include keeping track of your expenses, setting spending limits, and regularly reviewing your budget to make necessary adjustments based on your financial goals and priorities.

Customizing Your Budget to Fit Your Lifestyle

To effectively manage your finances, it’s essential to customize your budget to fit your unique lifestyle and financial circumstances. Consider your personal preferences, values, and long-term financial goals when allocating funds to different expense categories. Whether you prioritize travel, dining out, or saving for a specific goal, tailor your budget to align with your priorities and values.

Budgeting for your lifestyle also involves making conscious decisions about your spending and finding a balance between enjoying life today and securing your financial future.

The 50/30/20 Rule for Budget Allocation

Effective budgeting often involves following a budget allocation guideline like the 50/30/20 rule, which suggests allocating 50% of your income to essential expenses, 30% to discretionary spending, and 20% to savings and debt repayment. This approach provides a simple framework to ensure that you are allocating your income wisely and building a solid financial foundation for the future.

This rule can help individuals prioritize their spending and savings goals, while also encouraging responsible financial behavior and preventing excessive spending in non-essential categories.

Saving and Investing

Despite the variations in our individual financial goals, saving and investing play critical roles in achieving financial freedom. By understanding the importance of an emergency fund, the basics of investing, retirement planning options, and alternative investment strategies, individuals can enact a comprehensive plan to secure their financial future.

The Importance of an Emergency Fund

One of the fundamental steps in achieving financial stability is establishing an emergency fund. An emergency fund serves as a safety net, providing individuals with a financial cushion to navigate unexpected expenses such as medical emergencies, vehicle repairs, or temporary unemployment. By setting aside three to six months’ worth of living expenses, individuals can shield themselves from accumulating debt in times of crisis and maintain their long-term financial goals.

Understanding the Basics of Investing

On the journey to financial freedom, a solid understanding of investing is paramount. Investing allows individuals to grow their wealth over time by putting their money to work. It involves understanding the various investment options available, assessing risk tolerance, and developing a diversified investment portfolio that aligns with long-term financial objectives.

Investing in assets such as stocks, bonds, and real estate provides the potential for capital appreciation and income generation, offering individuals the opportunity to build wealth and achieve financial independence.

Retirement Planning: IRAs and 401(k)s

Importance of planning for retirement cannot be overstated. One of the most effective ways to save for retirement is by utilizing retirement accounts such as Individual Retirement Accounts (IRAs) and 401(k)s. These accounts offer tax advantages and long-term growth potential, providing individuals with a structured approach to accumulating wealth for their post-career years. It is essential to start contributing to these accounts as early as possible to take advantage of compounding growth and maximize retirement savings.

Exploring Other Investment Options: Real Estate, Stocks, Bonds

Investing in real estate, stocks, and bonds offers alternative pathways to grow wealth outside of traditional retirement accounts. Real estate investments provide the potential for rental income and property appreciation, while stocks and bonds offer opportunities for capital appreciation and income generation. Diversifying one’s investment portfolio across different asset classes can help mitigate risk and enhance overall investment returns.

Risks and How to Mitigate Them

An important aspect of investing is understanding the risks associated with various investment options and developing strategies to mitigate them. While investments offer the potential for high returns, they also carry the risk of loss. Retirement accounts such as IRAs and 401(k)s offer tax advantages and long-term growth potential, but individuals should be mindful of contribution limits, withdrawal penalties, and investment fees to optimize their retirement savings.

Managing Debts and Loans

Keep your financial house in order by effectively managing your debts and loans. This is a crucial step in achieving financial freedom and securing your money goals. By implementing smart strategies and understanding the differences between good and bad debt, you can take control of your finances and pave the way for a brighter financial future.

Strategies for Paying Off Debt Faster

Any effective strategy for paying off debt faster involves creating a realistic budget, prioritizing high-interest debts, and exploring debt consolidation options. By allocating extra funds to your highest-interest debt while making minimum payments on the rest, you can accelerate the debt payoff process. Additionally, consolidating multiple debts into one lower-interest loan can make it easier to manage and pay off debt more efficiently.

Understanding Good Debt vs. Bad Debt

One of the key elements of managing debts and loans is understanding the difference between good debt and bad debt. Good debt, such as a mortgage or student loan, can potentially increase your net worth or provide long-term benefits. Conversely, bad debt, such as high-interest credit card debt, can be detrimental to your financial health and should be addressed as a priority.

Avoiding bad debt and strategically utilizing good debt can significantly impact your financial well-being and set you on the path to financial freedom. By leveraging good debt responsibly, you can build assets and investments that contribute to your long-term financial security.

Navigating Student Loans, Mortgages, and Personal Loans

With careful planning and understanding, you can navigate the complex landscape of student loans, mortgages, and personal loans. Each type of loan requires a tailored approach for effective management. Student loans may offer flexible repayment options, while mortgages and personal loans require a clear understanding of interest rates, terms, and potential impact on your overall financial picture.

Understanding the nuances of each type of loan will empower you to make informed decisions and optimally manage your debt. This includes exploring the possibility of refinancing loans to secure better terms and potentially reduce the overall cost of borrowing.

The Snowball and Avalanche Methods

Mortgages, student loans, and other substantial debts can be effectively managed using the snowball and avalanche methods. The snowball method involves paying off the smallest debts first to gain momentum and motivation, while the avalanche method focuses on tackling high-interest debts first, potentially saving money on interest in the long run.

Avalanche method is a powerful debt reduction strategy that can save you a significant amount of money in interest payments over time, effectively accelerating your journey to financial freedom. By prioritizing high-interest debts, you can eliminate costly debt more efficiently and redirect those savings towards your other financial goals.

Increasing Your Income

For many individuals seeking financial freedom, the key to attaining their money goals lies in increasing their income. While minimizing expenses is important, there is only so much you can cut back. As a result, finding ways to boost your earnings becomes crucial in the pursuit of financial independence.

The Role of Side Hustles and Passive Income

Role Of Side hustles and passive income play an essential role in diversifying your income streams, reducing dependency on a single source of income, and providing financial stability. Side hustles and passive income avenues offer opportunities to earn additional money outside of your primary job, whether it’s through freelancing, investments, or creating a small business. These additional streams of income can be instrumental in achieving your financial goals and even reaching early retirement if managed effectively.

Tips for Negotiating Raises and Promotions

Negotiating raises and promotions can significantly impact your earnings potential and accelerate your journey to financial freedom. Here are some tips to help you successfully negotiate for better compensation:

- Do your research on industry standards for salaries and benefits.

- Highlight your contributions and achievements in your current role.

- Be prepared to articulate your value and the reasons why you deserve a raise or promotion.

Any negotiation for higher income should be approached with confidence and backed by concrete evidence of your performance and worth to the organization.

Investing in Your Education and Skills

Investing in your education and skills can open up new opportunities for career advancement and increased income. By acquiring new knowledge and honing your skills, you can position yourself for higher-paying roles and promotions within your field.

Your investment in education and skills development is an investment in your future earning potential. By staying current with industry trends and expanding your expertise, you can become more competitive in the job market and command a higher salary.

Entrepreneurship as a Path to Financial Freedom

Side hustles and entrepreneurship can serve as a viable path to achieving financial freedom. By starting a business or venturing into entrepreneurship, individuals have the opportunity to create multiple streams of income and build wealth over time. Entrepreneurship also offers the potential for unlimited earnings and the ability to pursue passionate endeavors while generating income.

For instance, creating a successful startup or business can lead to significant financial gains and provide the means for a more flexible and fulfilling lifestyle, ultimately contributing to long-term financial stability.

Investing in Real Estate for Passive Income

With the potential for regular cash flow and long-term appreciation, real estate investments can be a powerful means of generating passive income. By acquiring rental properties or engaging in real estate investment trusts (REITs), individuals can build a steady stream of income that is not directly tied to their daily labor.

Real estate offers the possibility of generating wealth through property appreciation and rental income, making it a popular choice for individuals seeking to build a substantial passive income stream.

Protecting Your Wealth

Not protecting your wealth can lead to significant financial loss. It is essential to take proactive steps to safeguard your assets and investments. In this chapter, we will discuss key strategies for protecting your wealth, including insurance, estate planning, emergency funds, and securing your financial information and investments.

Insurance: The Types You Need

Need insurance coverage to protect against potential financial risks. It is essential to have life insurance to provide for your loved ones in the event of your passing. Health insurance is crucial for covering medical expenses and ensuring access to quality healthcare. Additionally, homeowner’s or renter’s insurance protects your property and possessions from unexpected damage or loss. Auto insurance is necessary to cover costs in the event of a car accident or theft. Finally, disability insurance provides income protection if you are unable to work due to illness or injury. Thou, it is crucial to carefully review and compare insurance policies to ensure you have adequate coverage for your specific needs.

| Life Insurance | Provides financial support to beneficiaries in the event of the policyholder’s death. |

| Health Insurance | Covers medical expenses and healthcare services. |

| Homeowner’s or Renter’s Insurance | Protects property and possessions from damage or loss. |

| Auto Insurance | Covers costs related to car accidents or theft. |

| Disability Insurance | Provides income protection if unable to work due to illness or injury. |

Estate Planning and Wills

Wills play a vital role in estate planning by outlining your wishes for the distribution of assets and the care of any dependents. Through proper estate planning, you can minimize estate taxes and ensure a smooth transfer of wealth to your beneficiaries. Additionally, establishing a trust can provide added protection and control over your assets, allowing you to dictate specific conditions for their distribution. It is crucial to regularly review and update your will and estate plan to reflect any changes in your financial or personal circumstances.

Types of estate planning include wills, trusts, power of attorney, and guardianship arrangements. It is essential to work with a qualified estate planning attorney to ensure that your wishes are legally documented and that your assets are protected according to your preferences.

The Importance of an Emergency Fund Revisited

Insurance having an emergency fund is crucial for providing financial security in the face of unexpected expenses or income disruptions. It serves as a safety net, allowing you to cover essential costs without having to dip into your long-term investments or retirement savings. By maintaining an emergency fund, you can avoid accumulating high-interest debt and protect your financial stability.

It is recommended to have at least 3-6 months’ worth of living expenses saved in an easily accessible account, such as a savings or money market account. This provides a buffer against unforeseen circumstances, such as job loss, medical emergencies, or major household repairs.

Keeping Your Information and Investments Secure

Revisited keeping your financial information and investments secure is paramount in today’s digital age. With the increasing risk of identity theft and cybercrime, it is crucial to take proactive measures to safeguard your sensitive data and accounts. Be vigilant about monitoring your financial statements, using secure passwords, and implementing two-factor authentication for online banking and investment platforms. It is also wise to shred or securely dispose of any documents containing personal or financial information before discarding them.

With the rise of online transactions and digital platforms, protecting your identity and investments requires ongoing attention and diligence. Consider using reputable cybersecurity software and regularly updating your devices to ensure the highest level of protection against potential threats.

Final Words

To wrap up, achieving financial freedom is possible for anyone who is willing to take the necessary steps and make the necessary sacrifices. By following the essential steps outlined in this guide, you can set yourself on the path to attaining your money goals and living a life free from financial worries. It’s important to remember that achieving financial freedom is a journey, not a destination, and requires ongoing dedication and discipline. With the right mindset and a commitment to financial literacy, you can take control of your finances and build a solid foundation for a secure future.

Also Refer : Protecting Your Future – Understanding The Importance Of Insurance In Your Overall Financial Plan

FAQs

Q: What is Financial Freedom 101 – Essential Steps To Attain Your Money Goals?

A: Financial Freedom 101 is a comprehensive guide that provides essential steps and strategies to help individuals attain their money goals and achieve financial independence.

Q: Why is financial freedom important?

A: Financial freedom provides individuals with the ability to make choices without being limited by financial constraints. It offers security, peace of mind, and the opportunity to live life on one’s own terms.

Q: What are the key components of financial freedom?

A: The key components of financial freedom include budgeting, saving, investing, reducing and managing debt, creating multiple streams of income, and cultivating a mindset of abundance and wise financial decision-making.

Q: How can I create a realistic financial freedom plan?

A: To create a realistic financial freedom plan, start by setting clear and achievable financial goals, creating a budget, building an emergency fund, paying off high-interest debt, investing in assets, and continuously educating yourself about personal finance.

Q: What are the common obstacles to achieving financial freedom?

A: Common obstacles to achieving financial freedom include lack of financial literacy, excessive debt, impulsive spending habits, living beyond one’s means, and a scarcity mindset. Overcoming these obstacles requires discipline, commitment, and a willingness to make necessary lifestyle changes.

Q: How can I stay motivated on the journey to financial freedom?

A: To stay motivated on the journey to financial freedom, it’s essential to track your progress, celebrate milestones, seek support from like-minded individuals, educate yourself about personal finance, and visualize the future benefits of financial independence.

Q: Where can I find additional resources to support my financial freedom journey?

A: There are various resources available, including books, online courses, financial advisors, podcasts, and community groups dedicated to personal finance and financial independence. Additionally, reputable financial websites and blogs offer valuable information and tools to support your journey towards financial freedom.