Here’s a piece of advice that is often overlooked but can have a profound impact on your financial well-being: pay attention to your credit score. Your credit score is a crucial factor in determining your financial future, impacting everything from loan approvals to interest rates. Unfortunately, many people make common credit score mistakes that can have devastating effects on their overall financial health. In this blog post, we will discuss some of the most dangerous credit score mistakes to avoid and provide tips on how to position yourself for financial success.

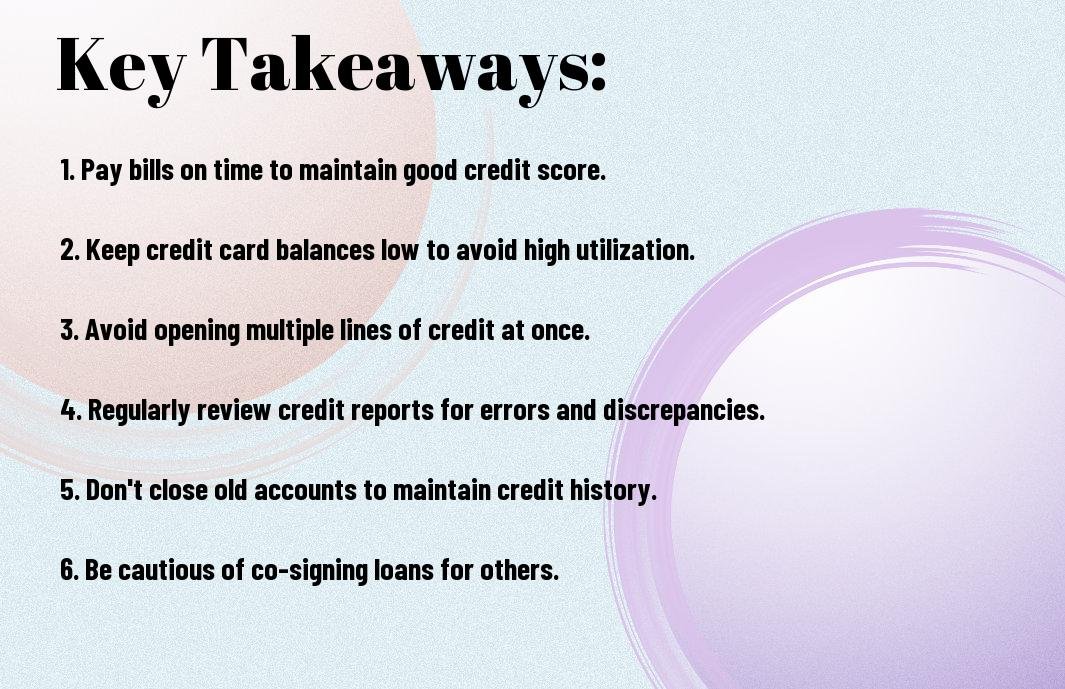

Key Takeaways:

- Regularly Monitor Your Credit Score: Checking your credit report and score regularly can help you catch any errors or suspicious activity early on and take steps to rectify them.

- Avoid Maxing Out Your Credit Cards: Keeping your credit card balances low and not maxing them out can help improve your credit score and demonstrate responsible financial behavior.

- Pay Your Bills on Time: Timely bill payments are crucial for maintaining a good credit score and can positively impact your financial standing in the long run.

Understanding Your Credit Score

Obviously, your credit score is a crucial factor in your financial life. It determines your eligibility for loans, credit cards, and even apartment rentals. Understanding how your credit score is calculated and what factors influence it can help you make informed financial decisions and improve your overall financial health.

Components of a Credit Score

For many people, their credit score seems like a mysterious number that fluctuates without rhyme or reason. In reality, it is calculated based on several key factors, including your payment history, amount of debt, length of credit history, new credit accounts, and types of credit used. Payment history is the most crucial factor, accounting for about 35% of your credit score. Missing payments or making late payments can significantly lower your score. The amount of debt you owe makes up about 30% of your score, so keeping your credit card balances low can have a positive impact.

Common Misconceptions About Credit Scoring

Credit scoring can be a complex and often misunderstood concept. One common misconception is that checking your credit score will hurt it. This is not true. When you check your own credit score, it is considered a “soft inquiry” and does not affect your score. Another misconception is that carrying a balance on your credit card will help your score. On the contrary, using too much of your available credit can actually hurt your score, even if you pay off the balance in full each month.

Your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, is a key factor in your credit score. Keeping this ratio below 30% can help improve your score and show lenders that you are responsible with your credit.

Mistake #1: Ignoring Your Credit Report

Keep in mind that your credit report plays a crucial role in determining your credit score. It reflects your financial behavior and helps lenders assess your creditworthiness. Ignoring your credit report can lead to overlooking errors or fraudulent activities that can negatively impact your credit score. 5 Factors That You Didn’t Know Affect Your Credit Score.

How Regular Checks Can Prevent Errors

An essential step in maintaining a healthy credit score is to regularly check your credit report. By reviewing it frequently, you can identify and dispute any inaccuracies or suspicious activities. This preventative measure can protect you from potential damage to your credit score and financial reputation.

Regular monitoring also empowers you to take control of your financial health. By staying informed about the contents of your credit report, you can address any issues promptly and maintain a favorable credit standing.

Setting Up Credit Report Monitoring

For added convenience, consider setting up a credit report monitoring service that provides regular updates and alerts about any changes to your credit report. This proactive approach allows you to stay informed about your credit status without having to manually review your report each time.

Regular monitoring is a key component of responsible financial management and can prevent potential setbacks caused by errors or unauthorized activities. Taking advantage of available tools for credit report monitoring demonstrates your commitment to maintaining a healthy credit score.

Mistake #2: Making Late Payments

To maintain a healthy credit score, it is crucial to avoid making late payments. Late payments can have a significantly negative impact on your credit score and financial well-being. It is important to understand the consequences of late payments and the strategies to ensure on-time payments.

The Impact of Late Payments on Your Credit Score

Payments that are reported as late to the credit bureaus can have a detrimental effect on your credit score. A single late payment can cause your credit score to drop, making it more difficult and expensive to borrow money in the future. Late payments can stay on your credit report for up to seven years, impacting your ability to qualify for loans, credit cards, and even affecting your ability to secure housing or employment.

Consistently making late payments can give lenders the impression that you are a high-risk borrower, resulting in higher interest rates and fees. This can ultimately cost you thousands of dollars over time in extra interest and reduced access to credit.

Strategies to Ensure On-Time Payments

Payments that are made on time are crucial for a healthy credit score. One effective strategy is to set up automatic payments for at least the minimum amount due on your bills. This ensures that you never miss a due date, helping to protect your credit score. Another strategy is to set up payment reminders, whether through calendar alerts or notifications from your financial institution, to ensure that you are always aware of upcoming due dates. It’s also important to consider adjusting your payment due dates to align with your payday, making it more manageable to stay on top of your bills.

OnTime payments demonstrate responsible financial behavior and can help build a positive credit history. By ensuring on-time payments, you can avoid the negative impact of late payments on your credit score, positioning yourself for financial success.

Mistake #3: Utilizing Too Much Credit

After making timely payments and keeping your credit utilization low, another common credit score mistake people make is utilizing too much credit. This can negatively impact your credit score and indicate to lenders that you may be at risk of overextending yourself financially.

Understanding Credit Utilization Ratio

Utilizing too much credit means you are using a high percentage of your available credit. Your credit utilization ratio is the amount of credit you are currently using compared to your total available credit. For example, if you have a credit limit of $10,000 and you have a balance of $5,000, your credit utilization ratio would be 50%. Lenders typically like to see a credit utilization ratio of 30% or less.

Tips for Balancing Your Credit Use

The key to balancing your credit use is to keep your credit utilization ratio low. Consider the following tips to help you maintain a healthy ratio:

- Pay off high-interest debt first

- Use your credit sparingly

- Avoid closing old accounts

Assume that lenders prefer to see a pattern of responsible credit use over time. It’s best to keep your credit utilization ratio consistently low to positively impact your credit score.

Utilization plays a significant role in determining your credit score. It is important to control your credit utilization and aim for a ratio of 30% or lower. This will show lenders that you are responsible with your credit and can help you maintain a healthy credit score over time.

Mistake #4: Applying for Unnecessary Credit

For many individuals, the temptation to apply for new credit cards or loans can be strong, especially when offers promising rewards or discounts are involved. However, applying for unnecessary credit can have a negative impact on your credit score and overall financial health.

Each time you apply for new credit, whether it’s a credit card, personal loan, or mortgage, the lender will perform a hard inquiry on your credit report. Hard inquiries can lower your credit score by a few points, and multiple inquiries within a short period of time can significantly impact your score.

How Each Application Affects Your Score

Application for new credit could lead to a lower credit score, potentially making it more difficult to qualify for future loans or credit cards. It also indicates to lenders that you may be taking on more debt than you can handle, which can be a red flag for potential lenders.

Even if you’re not approved for the new credit, the hard inquiry can still have a negative impact. It’s important to be mindful of when and why you are applying for new credit to avoid unnecessary damage to your credit score.

Selective Credit Seeking and Its Benefits

Unnecessary credit seeking can be avoided by being selective with the credit you apply for. Only apply for credit when you genuinely need it and have thoroughly researched the best offers available. Being selective in your credit seeking can help you maintain a healthy credit score and financial stability.

Any unnecessary credit applications can lead to a lower credit score and potential financial setbacks. It’s important to weigh the benefits and drawbacks of applying for new credit and make informed decisions to protect your financial well-being.

Mistake #5: Closing Old Accounts

Unlike other credit score mistakes, closing old accounts may seem like a responsible financial move. However, this action could have a negative impact on your credit score.

Why Account Age Matters

Closing old accounts can shorten your average account age, which is a key factor in your credit score calculation. The length of your credit history contributes to 15% of your FICO score and lenders view a longer credit history as more favorable. Therefore, closing old accounts can potentially lower your credit score and hinder your ability to qualify for favorable loan terms.

Also Read:- Borrowing With Confidence – How To Boost Your Chances Of Loan Approval

Additionally, closing old accounts can also decrease the total amount of credit available to you, which in turn can hurt your credit utilization ratio. This ratio, which measures the amount of credit you are using compared to your total available credit, is another significant factor in your credit score calculation.

How to Decide Which Accounts to Keep Open

To determine which accounts to keep open, consider closing accounts with higher annual fees or those that no longer align with your financial goals. However, it’s important to keep accounts that are older, have a positive payment history, and contribute to a high total credit limit.

The key is to strike a balance between managing your credit responsibly and maintaining a favorable credit score.

Mistake #6: Co-Signing Loans

Unlike some of the previous mistakes we’ve discussed, co-signing a loan may seem like a generous act to help a friend or family member in need. However, it can have serious implications for your credit score and financial stability. Co-signing a loan means that you are taking on the responsibility for the debt if the borrower fails to make payments. This can have a significant impact on your credit score and your ability to secure future credit.

Risks of Co-Signing Explained

Anytime you co-sign a loan, you are putting your own financial well-being at risk. If the primary borrower defaults on the loan, you are legally obligated to repay the debt. This could result in missed payments and a damaged credit score for you. Additionally, if the primary borrower declares bankruptcy, the burden of the debt will fall entirely on you. Co-signing a loan can lead to strained relationships and unnecessary stress as you navigate the repercussions of the borrower’s financial choices.

Alternatives to Co-Signing for Friends and Family

Mistake no. 6: Co-signing a loan for a friend or family member may seem like the only option to help, but there are alternative ways to offer support without putting your own financial stability at risk. Gift funds or offering to help them increase their creditworthiness through other means are potential alternatives to consider. You can also suggest seeking assistance from financial advisors or non-profit organizations that specialize in financial counseling and debt management.

Co-signing a loan can have detrimental effects on your credit score and financial future. It’s important to consider these alternatives and advise your friend or family member on the potential impact that co-signing could have on your financial health, as well as their own.

Building a Solid Credit Foundation

Not having a solid credit foundation can negatively impact your financial health. Building a strong credit score is essential in achieving financial success and stability. Your credit score plays a significant role in your ability to secure loans, obtain favorable interest rates, and even rent an apartment. To avoid costly mistakes and position yourself for financial success, it is crucial to understand how to build a solid credit foundation.

Beyond Corrections: Proactive Steps to Improve Your Score

Proactive steps are essential in improving your credit score. Beyond simply correcting errors on your credit report, it’s important to take proactive measures to build a positive credit history. This may include making timely payments, keeping credit card balances low, and refraining from opening multiple new credit accounts at once. Additionally, consider diversifying your credit mix by having a combination of installment loans and revolving credit accounts.

Proactively improving your credit score can lead to better financial opportunities and more favorable terms for future loans and credit accounts.

Leveraging Good Credit for Financial Success

Any individual with a good credit score has the potential to leverage it for financial success. Good credit allows you to qualify for competitive interest rates on loans, secure higher credit limits, and may even reduce your insurance premiums. By maintaining a good credit score, you position yourself to take advantage of various opportunities, including obtaining a mortgage, financing a car, or even starting a business.

Building a strong credit foundation and leveraging good credit can lead to increased financial stability, better loan terms, and more opportunities for achieving your financial goals.

Conclusion

Ultimately, being aware of and avoiding common credit score mistakes can significantly impact your financial success. By maintaining a good credit score, you can qualify for lower interest rates on loans, secure better credit card offers, and even lower your insurance premiums. Additionally, a healthy credit score can give you the leverage you need to negotiate better terms on large purchases such as a car or a home.

By educating yourself on the potential pitfalls that can negatively impact your credit score, you can position yourself for financial success. Avoiding these common mistakes, such as missing payments, carrying high balances, and applying for multiple new credit accounts, can help you build and maintain a strong credit score. Remember that your credit score is a reflection of your financial responsibility, so it’s crucial to prioritize good credit habits to secure a stable and prosperous financial future.

FAQ

Q: What are common credit score mistakes to avoid?

A: Common credit score mistakes to avoid include missing payments, maxing out credit cards, closing old accounts, and applying for multiple new credit accounts in a short period of time. These can all have a negative impact on your credit score.

Q: Why is it important to avoid these credit score mistakes?

A: Avoiding these credit score mistakes is important because your credit score plays a crucial role in your financial well-being. It affects your ability to qualify for loans, credit cards, and even rental housing. A lower credit score can also result in higher interest rates and insurance premiums.

Q: How can I improve my credit score?

A: You can improve your credit score by making all of your payments on time, keeping your credit card balances low, and avoiding opening unnecessary new credit accounts. Regularly checking your credit report for errors and addressing them can also help improve your credit score.

Q: Is it true that checking my credit score can lower it?

A: No, checking your own credit score will not lower it. This is known as a “soft inquiry” and does not impact your credit score. However, when a lender or creditor checks your credit as part of a credit application (a “hard inquiry”), it may cause a small, temporary dip in your score.

Q: How long does it take to improve a credit score?

A: The time it takes to improve a credit score can vary depending on individual circumstances. Making consistent, positive credit habits can improve your score over time, but significant improvement may take several months to a year or more. Patience and diligence are key.

Q: Can I repair my credit on my own, or do I need professional help?

A: Many people are able to successfully improve their credit on their own by following smart financial habits and monitoring their credit report regularly. However, if you feel overwhelmed or have complex credit issues, seeking professional help from a reputable credit counseling agency may be beneficial.

Q: How can I maintain a good credit score once I’ve improved it?

A: To maintain a good credit score, continue to make all of your payments on time, keep credit card balances low, and avoid taking on more credit than you need. Regularly monitoring your credit report for any errors and addressing them promptly is also important for maintaining a healthy credit score.